(Reuters) – London’s benchmark index moved higher on Tuesday and logged its best day in over one week, as the global tech rout eased, while the focus shifts to the U.S. Federal Reserve rate cut decision scheduled later in the week.

The blue-chip FTSE 100 closed 0.3% higher at 8,533.87 points.

The domestically focussed FTSE 250 rose 1.1%, and also logged its best day in over a week, snapping a four-day losing streak.

The household goods and home construction sector was the top sector gainer, gaining 2.4%.

The pound slipped 0.5% after rising for the past three sessions, providing a tailwind for exporters.

Sentiment dipped on Monday as a low-cost Chinese artificial intelligence model emerged, prompting investors to question the dominance of AI bellwethers and their suppliers, which had previously driven high share prices for tech and chip firms.

In the present session, the investors may have stepped off the sell pedal, with Europe’s STOXX 600 touching an intraday record high while Wall Street also opened higher. [.EU] [.N]

However, technology shares struggled to regain their footing.

Most of the attention is headed towards earnings of four of the seven magnificent companies slated for later in the week.

Also in focus is the Fed’s first interest rate decision of the year on Wednesday which is widely expected to hold its lending rate steady. Additionally, the December reading of personal consumption expenditures is scheduled for Friday.

In stock related moves, Computacenter jumped 8.8% after the technology and services provider reported its most profitable second half in its history.

The retail sector gained 2.3%, lifted by a 5.4% gain in Pets at Home Group after the company reported its third-quarter results.

Keeping gains in check, Industrial metal miners lost 1.6%, falling to their lowest level in over two weeks as copper prices hit over a two-week low. [MET/L]

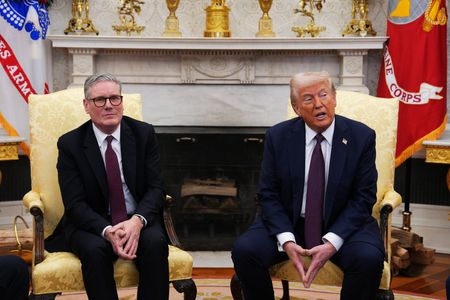

On the macro-front, British Prime Minister Keir Starmer and finance minister Rachel Reeves met business leaders, seeking to hammer home their message that ministers had been told to refocus attention on economic growth with every major decision.

(Reporting by Pranav Kashyap in Bangalore; Editing by Vijay Kishore and Elaine Hardcastle)