By Eduardo Baptista

BEIJING (Reuters) – Quantitative hedge fund, High-Flyer, built a 100 billion yuan ($13.79 billion) portfolio using artificial intelligence models to make investment decisions, but in 2023 decided to change track to focus on developing the most cutting-edge AI.

In a post on its official WeChat account, Hangzhou Huanfang Technology Ltd Co., as the company is officially called, said it would focus on pursuing artificial general intelligence (AGI).

“High-Flyer will concentrate its resources and strength, wholly devote itself to serve AI technology that benefits all of humanity, create a new independent research group, and explore the essence of AGI,” the company said.

Microsoft-backed OpenAI, which developed ChatGPT, defines AGI as autonomous systems that surpass humans in most economically valuable tasks.

It’s the next generation of AI models and in a post on X last week OpenAI CEO Sam Altman said his company had not yet achieved that milestone.

The independent research group envisaged by High-Flyer was DeepSeek, whose models have rocked the global technology sector in recent weeks. High-Flyer’s founder and controlling shareholder, Liang Wenfeng, doubles as DeepSeek’s low-profile leader.

The sophistication of DeepSeek’s models has been widely praised by its Silicon Valley competitors, a first for a Chinese AI model, but the startup’s claims that it used a fraction of the computing power deployed by leading U.S. firms for their own models triggered a selloff of tech shares worldwide.

It is unclear how close DeepSeek is to developing an AGI model.

While DeepSeek’s success appears to have happened almost overnight, High-Flyer shows how this meteoric rise has been over a decade in the making.

Under Liang’s leadership, the fund spent years studying and experimenting with overseas AI models, applying this technology to their business, and investing tens of millions of dollars in high-end Nvidia chips to provide the computing power necessary to support this AI-centric strategy, according to a Reuters review of High-Flyer’s websites and official WeChat accounts.

SUPERCOMPUTING CLUSTERS

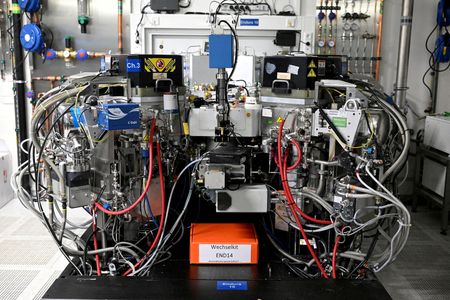

This includes building two AI supercomputing clusters, entirely made up of Nvidia’s powerful A100 chips, which Washington banned from export to China in September 2022.

High-Flyer’s A100 clusters were built and put into operation long before the export controls were announced. Its first cluster, made up of 1,100 A100 chips, cost 200 million yuan and was put into operation in 2020, while its second cluster, made up of around 10,000 A100 chips, was completed a year later with a cost of 1 billion yuan, according to the company’s website and several WeChat posts.

In 2022, High-Flyer AI researchers presented a strategy at an Nvidia conference that the firm had developed to maximize the second cluster’s efficiency when training AI models.

It is unclear how much High-Flyer has invested in DeepSeek. High-Flyer has an office located in the same building as DeepSeek, and it also owns patents related to chip clusters used to train AI models.

Liang has a 55% stake in privately held High-Flyer and holds 99% of the voting rights, according to Chinese corporate records. The remaining shares are held by other executives in the fund.

DeepSeek has so far only claimed to use Nvidia’s much less powerful H800 and H20 chips for training its DeepSeek-V3 model and its predecessor DeepSeek-V2, which triggered an AI model price war in China when it was released last May.

However, some tech executives have publicly claimed DeepSeek has far more computing power at its disposal.

Scale AI CEO Alexandr Wang said during an interview with CNBC on Thursday, without evidence, that DeepSeek has 50,000 Nvidia H100 chips, which he claimed were not disclosed because that would violate Washington’s export controls, which banned the export of H100 chips to China at the same time as the less powerful A100.

DeepSeek did not respond to a request for comment on the allegation. Nvidia also did not immediately respond to an email asking for comment.

But Liang’s concern with computing power when discussing DeepSeek’s future echoes his quant fund’s massive investment in AI clusters. Asked in an interview with Chinese media outlet Waves last July if High-Flyer planned to split DeepSeek from the company and take it public, Liang answered:

“We have no plans to raise money in the short term, the problem we face has never been money, but the embargo on high-end chips.”

($1 = 7.2507 Chinese yuan renminbi)

(Reporting by Eduardo Baptista; Editing by Sharon Singleton)