(Reuters) – U.S. Steel reported fourth-quarter loss and revenue that matched Wall Street estimates on Thursday, dented by price declines and a bumpy demand environment.

The industry has been struggling, as distributors have refrained from purchasing material in excess of their inventory amid a supply glut fueled by domestic production and imports.

U.S. Steel is attempting to salvage an about $15 billion sale to Nippon Steel and navigate rivals Cleveland-Cliffs and Nucor vying for a shot at a takeover.

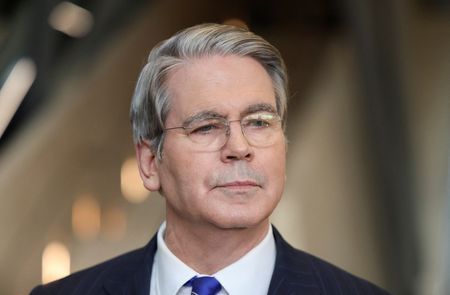

Activist investor Ancora has nominated nine candidates to U.S. Steel’s board of directors, as it looks to oust its CEO David Burritt and push the company to pull the deal with Nippon .

On an adjusted basis, the company lost 13 cents per share during the quarter ended Dec. 31, in line with analysts’ estimates, according to data compiled by LSEG.

The company’s overall quarterly revenue fell 15% to $3.5 billion from a year ago, but met estimates.

(Reporting by Nathan Gomes in Bengaluru; Editing by Sriraj Kalluvila)