By Katya Golubkova

TOKYO (Reuters) – Oil prices retreated on Tuesday after U.S. President Donald Trump agreed to hold off imposing steep tariffs on Mexico and Canada, the two biggest foreign oil suppliers to the United States, for a month.

Brent futures fell 41 cents, or 0.5%, to $75.55 a barrel at 0149 GMT, while U.S. West Texas Intermediate (WTI) crude declined 75 cents, or 1%, to trade at $72.41.

Both Canadian Prime Minister Justin Trudeau and Mexican President Claudia Sheinbaum said they had agreed to bolster border enforcement efforts in response to Trump’s demand to crack down on immigration and drug smuggling.

That would pause for 30 days 25% tariffs, with a 10% tariff on energy imports from Canada, that were due to take effect on Tuesday.

Despite the deal to pause tariffs, ING analysts said Canada would remain vulnerable to trade wars unless it expanded its export options beyond the U.S. with more pipelines from oil fields to ports.

“It would take several years to build this infrastructure, but it would provide Canadian producers more flexibility and the potential for more destinations for Canadian oil,” ING said.

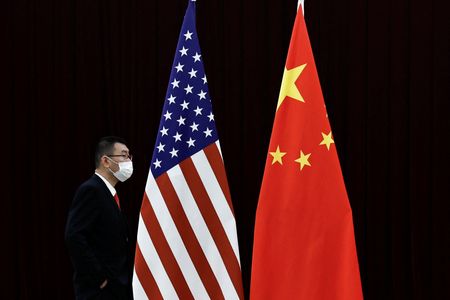

Trump plans to speak with Chinese President Xi Jinping as soon as this week, the White House said, as a 10% duty on all China goods is set to take effect later on Tuesday.

The Trump administration’s plans for trade tariffs come with inflation risks, three Federal Reserve officials warned on Monday, with one arguing that uncertainty over the outlook for prices calls for slower interest-rate cuts than otherwise.

Lower rates typically spur economic growth and oil demand.

The Organization of the Petroleum Exporting Countries and its allies, a group known as OPEC+, on Monday discussed a call by Trump to raise production but agreed to stick to its policy of gradually raising oil output from April.

On the demand side, investors will be looking out for weekly U.S. oil stockpile data for the week to Jan. 31. Analysts polled by Reuters expected crude inventories rose, while gasoline and distillate inventories likely fell.

The inventory reports are due from the American Petroleum Institute industry group at 4:30 p.m. ET (2130 GMT) on Tuesday and from the U.S. Energy Information Administration at 10:30 a.m. (1530 GMT) on Wednesday.

(Reporting by Katya Golubkova in Tokyo; Editing by Lincoln Feast and Sonali Paul)