(Reuters) – Ratings agency Moody’s downgraded China Vanke further on Tuesday and maintained its negative outlook on the embattled property developer that is grappling with a liquidity crisis and sluggish sales impacted by an ailing property sector.

Moody’s lowered its corporate family rating to ‘Caa1’ from ‘B3’. Entities rated ‘Caa’ are judged to be speculative and are subject to very high credit risk, according to Moody’s.

Ratings agencies Fitch and S&P Global downgraded the property developer in January, citing eroding financial flexibility and an uncertain sales outlook for 2025.

Moody’s, which downgraded its ratings for the second time this year, said the company’s sluggish sales performance, sustained margin pressures, and significant losses on asset disposals and impairment charges have hurt its equity base.

In late January, China Vanke’s chairman Yu Liang and CEO Zhu Jiusheng stepped down after it forecast a record $6.2 billion net loss for 2024. The Shenzhen government has since tightened control over Vanke with new management appointments.

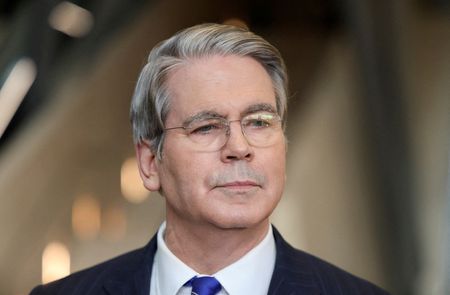

“Greater oversight from the largest government shareholder, as a result of the recent management reshuffle, could help maintain existing funding channels and provide near term liquidity support,” Roy Zhang, a Moody’s ratings vice president and senior analyst said.

However, the oversight cannot fully offset Vanke’s weak operations and the lack of a clear refinancing plan for its debt maturities over the next 6-to-12 months, Zhang said.

An upgrade to China Vanke’s rating is unlikely, given the negative outlook, Moody’s said in a statement.

“However, positive rating momentum could emerge if the company improves its operating cash flow, liquidity and access to funding over the next 12-18 months,” Moody’s said.

(Reporting by Nikita Maria Jino in Bengaluru; Editing by Mrigank Dhaniwala)