By Jonathan Stempel

NEW YORK (Reuters) – Berkshire Hathaway on Saturday reported record annual profits and boosting its cash stake to $334.2 billion, as Warren Buffett used his annual shareholder letter to caution Washington to spend money wisely and take care of those who get the “short straws in life.”

Buffett’s admonition came as many investors worry U.S. lawmakers won’t rein in soaring fiscal deficits, and could make them worse by extending tax cuts backed by President Donald Trump.

The 94-year-old Buffett, the world’s sixth-richest person and arguably its most famous investor, also acknowledged his advanced age, telling shareholders he uses a cane and will spend less time fielding their questions at Berkshire’s annual meeting on May 3.

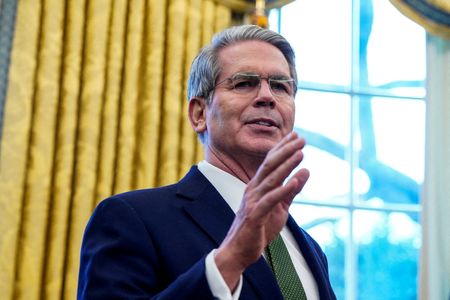

He nonetheless assured shareholders they would be in good hands after he turns over the conglomerate’s reins to Vice Chairman Greg Abel, saying the 62-year-old Abel has “vividly shown his ability” to deploy capital.

“It won’t be long” before Abel takes over, Buffett said.

Buffett’s letter was accompanied by Berkshire’s annual report, where it reported a third straight record annual operating profit, rising 27% to $47.44 billion.

Quarterly operating profit rose 71% to $14.53 billion, also a record, and which analysts viewed as solid.

Net income for the full year totaled $89 billion, including gains from Berkshire’s common stock investments such as Apple and American Express.

Berkshire’s cash stake reflected high business valuations and nine straight quarters of selling more stocks than it bought. The selling included Apple, which remained its largest stock investment.

“Often, nothing looks compelling; very infrequently we find ourselves knee-deep in opportunities,” Buffett wrote.

‘FISCAL FOLLY’

This year is Buffett’s 60th at the helm of Berkshire, which he transformed from a failing textile company into a $1.03 trillion conglomerate with dozens of businesses in insurance, railroad, energy, industrial, retail and other sectors.

“Berkshire’s activities now impact all corners of our country. And we are not finished,” Buffett said.

Buffett said Berkshire will continue preferring equities, primarily U.S. stocks, over cash, even as it resists paying a dividend to shareholders, which it has not done since 1967.

He said reinvesting in Berkshire is one reason the Omaha, Nebraska-based company paid $26.8 billion of federal taxes last year, 5% of all payments by corporate America. Buffett himself is worth $149.5 billion, Forbes magazine said,

But he also sent a cautionary message to Washington, lamenting how capitalism “has its faults and abuses–in certain respects more egregious now than ever,” with malfeasance by “scoundrels and promoters” in full force.

He urged lawmakers to help preserve a stable U.S. dollar, saying “fiscal folly” can destroy the value of paper money and the country has at times “come close to the edge.”

Buffett said long-term success of Berkshire and the American economy, which he called the “American miracle,” has depended on people’s ability to participate.

That, he said, is something Uncle Sam can encourage, or take away.

“Take care of the many who, for no fault of their own, get the short straws in life. They deserve better,” Buffett wrote, addressing the government.

“And never forget that we need you to maintain a stable currency and that result requires both wisdom and vigilance on your part,” he added.

Cathy Seifert, an analyst at CFRA Research who rates Berkshire “hold,” said: “Talking about the business of America being messy was his way of addressing the political landscape and its impact on the macroeconomic environment. He is warning Washington: Be careful where you tread.”

FEWER BUYING OPPORTUNITIES

While Berkshire has not made a major purchase of an entire company since 2016, Buffett said it is likely to increase its combined $23.5 billion of investments in five Japanese trading houses: Itochu, Marubeni, Mitsubishi, Mitsui and Sumitomo.

Other stocks appear pricey, with the Standard & Poor’s 500 hitting a new high on Wednesday and the Nasdaq just 3% below its December 16 peak.

Berkshire’s size also inhibits its shares from trouncing the indexes, as they did decades ago.

The company’s stock price has risen 15% in the last year, while the Standard & Poor’s 500 rose 18%.

Over the last decade, Berkshire’s stock price has risen 225%, while the index rose 241% including dividends and 185% excluding dividends, Reuters data show.

“They will have lots of buying opportunities but Berkshire will never be the large double-digit compounder it had been,” said Bill Smead, chief investment officer at Smead Capital Management in Phoenix.

At Berkshire’s annual meeting, Buffett will spend less time on the stage in a downtown Omaha arena where he, Abel and Vice Chairman Ajit Jain will answer shareholder questions.

Tens of thousands of people attend the meeting and a weekend of shareholder events, including shopping.

Buffett told Fortune magazine last month that he was still having fun and able to do a few things reasonably well, while other activities had been “eliminated or greatly minimized.”

The meeting will also not feature the traditional movie created by Buffett’s daughter Susie.

In discussing his age, Buffett said he talks regularly on Sundays with his 91-year-old sister Bertie, using an old-fashioned phone.

“We cover the joys of old age and discuss such exciting topics as the relative merits of our canes,” he said. “In my case, the utility is limited to the avoidance of falling flat on my face.”

(Reporting by Jonathan Stempel, in New York; Writing by Carolina Mandl in New York; Editing by Diane Craft)