(Reuters) – Smith+Nephew reported annual sales and profit broadly in line with expectations on Tuesday, as newer products and a recovery in the U.S., helped the medical products maker offset the impact of sluggish demand from China that has been weighing on shares.

The company has been hit by weak demand for its knee implants in China, which accounts for about 5% of overall sales, and fewer orders from the country’s bulk-buying programme, forcing Smith+Nephew to downgrade its own forecasts for 2024.

Its shares jumped as much as 10% on London’s blue-chip FTSE 100 index by 0900 GMT, after what some analysts said was a “strong finish” to the year and a “relief”.

Founded in 1856, Smith+Nephew makes orthopaedic implants and prosthetics, along with wound dressings and other surgical aids. The company has been reworking its strategy to cement growth in newer markets and stabilise more mature ones as demand slows.

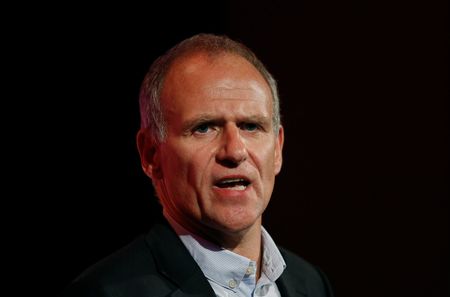

“There is much more to be done, but we have made solid progress fixing the foundations and expect a step-up in returns in 2025, including significant margin expansion,” CEO Deepak Nath said in a statement.

Britain’s largest medical products maker by market value projected that 2025 revenue would increase around 5% on an underlying basis, compared with analysts’ consensus of 4.8%, as compiled by the company.

Still, the company forecast first-quarter revenue growth of only 1% to 2%, as challenges in China continue to weigh on it. In the same quarter last year, Smith+Nephew’s sales had increased by 2.9%.

“We remain of the view that (the company) needs to do something different to unlock value and while pressure is mounting, we prefer to sit on the sidelines at this stage,” Panmure Liberum analysts said in a note.

Revenue of $5.81 billion and trading profit of $1.05 billion for 2024 were slightly above expectations of $5.78 billion and $1.03 billion, respectively, after U.S. revenues which make up more than half of overall sales, grew 4.8%.

(Reporting by Pushkala Aripaka in Bengaluru; Editing by Sherry Jacob-Phillips and Tomasz Janowski)