By Sarah Young

LONDON (Reuters) -Britain’s Rolls-Royce lifted its mid-term targets to reflect its confidence in future profit growth after a plan to improve engines and cut costs helped its results beat expectations, pushing its shares up 15% on Thursday.

The upgrade showed the progress made by Rolls-Royce over the last two years after former BP executive Tufan Erginbilgic took over as CEO, describing the company as a “burning platform” in need of a fundamental turnaround.

Shares in Rolls-Royce surged to 726 pence, an all-time high.

In its results statement, the group also announced a dividend of 6 pence per share, having flagged in August that it would reinstate a payout after a five-year pandemic break, and launched a 1 billion pound ($1.27 billion) share buyback.

Citi called the results “very strong” while Richard Hunter at Interactive Investor said the unexpected share buyback was “lighting a fire under the shares”.

“Strong 2024 results build on our progress last year, as we transform Rolls-Royce into a high-performing, competitive, resilient, and growing business,” Erginbilgic said in a statement.

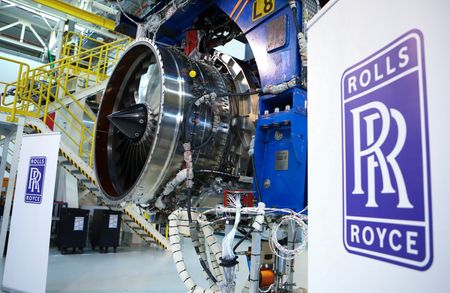

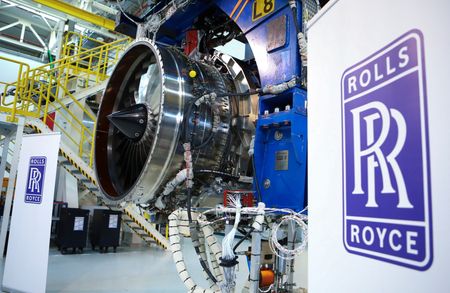

Rolls, Airbus’s exclusive engine partner on its widebody planes and a supplier to Boeing’s 787, said profits had been boosted by cost-savings, as well as tweaks to ensure engines can fly for longer before maintenance, and improved contract terms.

The company, which also powers ships, submarines and makes power generation systems, said it would meet its previous mid-term targets this year, two years earlier than planned, and was now guiding to mid-term underlying operating profit of 3.6 billion pounds to 3.9 billion pounds.

Profit for this year is expected to be between 2.7 billion pounds and 2.9 billion pounds, Rolls said, and compared to the 2.46 billion pounds it posted last year, comfortably ahead of a consensus forecast, and up 55% on last year.

Over the last year, London’s blue-chip index has risen 13%, while Rolls-Royce has doubled in value. Since Erginbilgic joined in January 2023, its shares have risen more than five-fold.

($1 = 0.7900 pounds)

(Reporting by Sarah Young, Editing by Paul Sandle and Barbara Lewis)