By Matthias Inverardi, Tom Sims and Amir Orusov

(Reuters) -Germany’s DHL plans to cut 8,000 jobs in Germany this year, the biggest staff reduction programme in its home market in at least two decades, responding to falling letter volumes as well as what it says is overly strict regulation.

Shares rose to their highest level since February 6, 2024, on the news, which includes savings of more than 1 billion euros ($1.1 billion) by 2027. At 1415 GMT, shares were up 12.3%, the biggest gainer among German blue-chip stocks.

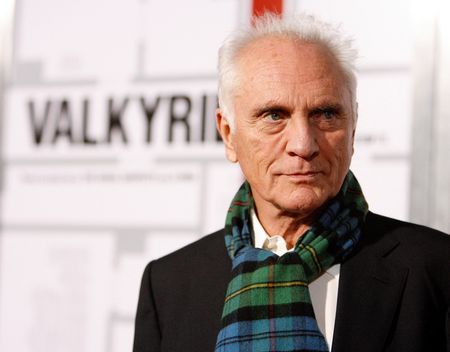

CEO Tobias Meyer said that even though DHL raised letter postage prices recently, it wasn’t enough to shore up earnings due to limits set by German regulators.

The Verdi labour union criticised the planned job cuts and urged politicians to act, also blaming regulation and insufficient stamp price increases.

The planned cuts account for just 1.3% of the global workforce of DHL, in which Germany still holds a 16.99% stake via state lender KfW.

Logistics companies are likely to see slower profit growth this year due to softer demand and easing supply-chain disruptions, Parash Jain, HSBC’s global head of transport and logistics research, said ahead of the results.

Jain expects transportation companies to cut costs, with growth in global container trade and air freight tonnes expected to halve in 2025.

DHL does not have much exposure to U.S. President Donald Trump’s pause on the decision to scrap “de minimis,” duty exemption for low-value packages, Meyer said on the call.

DHL shares have underperformed the wider logistics sector over the past year.

Meyer told Reuters there were no plans to separate the P&P business, although it has struggled for years with cost inflation and declining letter volumes.

DHL posted a 7% decline in 2024 earnings before interest and tax to 5.89 billion euros, still surpassing analysts’ expectations of 5.81 billion euros in a company-provided consensus.

For 2025, the group expects an operating profit of more than 6 billion euros, which is below analysts’ expectations of 6.29 billion euros. The forecast does not account for potential impacts from changes in tariff or trade policies.

DHL maintained a 1.85 euro dividend per share for 2024 and increased its share buyback program by 2 billion euros to 6 billion euros, extending it until 2026.

($1 = 0.9248 euros)

(Reporting by Matthias Inverardi, Tom Sims and Amir Orusov; Additional reporting by Anastasiia Kozlova; Writing by Christoph Steitz; Editing by Subhranshu Sahu, Louise Heavens and Bernadette Baum)