By Nikhil Sharma and Purvi Agarwal

(Reuters) -European stocks rallied on Friday, with German equities leading gains after the country’s political parties agreed a historic deal to ramp up state borrowing.

The pan-continental STOXX 600 climbed 1.1%. Germany’s benchmark index gained 1.9%, while mid-caps advanced 2.4%. Small-caps climbed 3.3%.

Conservative chancellor-in-waiting Friedrich Merz said he had secured the crucial backing of the Greens for a massive increase in state borrowing, clearing the way for the outgoing parliament to approve it next week.

“Today’s political deal should have ensured a two-thirds majority in the parliament at next Tuesday’s vote. Nevertheless, the chance of a surprise failure is still not zero,” said Carsten Brzeski, ING’s global head of macro.

“Regardless, the chances of a cyclical rebound on the back of positive sentiment effects and later actual spending, have clearly increased.”

Sectors expected to benefit the most from the reforms jumped after the news. European banks led gains with a 2.6% advance, followed by the industrial goods sector that houses defence stocks.

The continent-wide aerospace and defence index closed 4.1% higher, while the volatility index eased to its lowest since March 4, after jumping to its highest in more than seven months earlier in the week.

Although the news renewed risk-appetite in Europe, the benchmark STOXX 600 index still logged a weekly loss, its worst since December.

U.S. President Donald Trump’s back and forth on tariffs has prompted volatile moves on markets, and his threat to slap a 200% tariff on wine and other alcohol from the European Union in response to the bloc’s levies on U.S. whiskey, has contributed to recent declines.

“The ongoing uncertainty about tariffs… is raising questions about the outlook for growth and that’s having a particular impact on risky assets generally,” said Richard Flax, chief investment officer at Moneyfarm.

Some investors remained optimistic despite the trade war gloom because of potential progress towards a ceasefire in Ukraine.

Among other stocks, Kering slumped 10.7% to the bottom of the STOXX 600 after its Italian luxury brand Gucci appointed Georgian designer Demna as its artistic director.

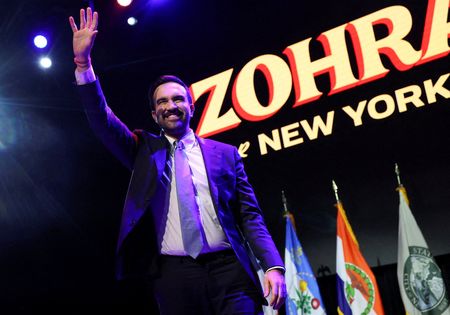

Universal Music Group (UMG) sank 8.8% after Bill Ackman’s Pershing Square cut its stake in the company.

On the economic front, German inflation unexpectedly fell in February, building a case for further policy easing from the European Central Bank.

(Reporting by Nikhil Sharma, Medha Singh and Purvi Agarwal in Bengakuru; additional reporting by Samuel Indyk; Editing by Sonia Cheema, Shinjini Ganguli, Alex Richardson and Christina Fincher)