By Casey Hall

SHANGHAI (Reuters) – The bosses of some of the world’s biggest companies met with Chinese President Xi Jinping in Beijing on Friday.

It’s the second year running that chairmen, CEOs and company presidents of major global firms operating in China stuck around after the China Development Forum, an annual business conference held last weekend, to meet with the Chinese leader.

While last year’s meeting was focused on executives of U.S. companies doing business with China, this year’s list of more than 40 attendees was a more international array of business head honchos.

RAY DALIO, BRIDGEWATER ASSOCIATES

Billionaire Dalio, head of the world’s largest hedge fund, is considered a global authority on investing in China.

BILL WINTERS, CEO, STANDARD CHARTERED

The bank was the first to set up a wholly foreign-owned securities firm in China when the country lifted foreign ownership caps in the sector in 2020.

STEVE SCHWARZMAN, CEO, BLACKSTONE GROUP

Ahead of the meeting with Xi, Schwarzman said that Blackstone, the world’s largest alternative asset manager, would “play an active role in promoting U.S.-China economic and trade cooperation.”

PAUL HUDSON, CEO, SANOFI

Last December the French drugmaker announced its largest investment in China to date, a 1 billion euro ($1.1 billion) insulin production base in Beijing.

AMIN NASSER, PRESIDENT AND CEO, SAUDI ARAMCO

Saudi Aramco has announced two major refining and petrochemical joint ventures with Chinese state oil giants. The Middle Eastern energy firm has also recently stepped up cooperation with private Chinese companies.

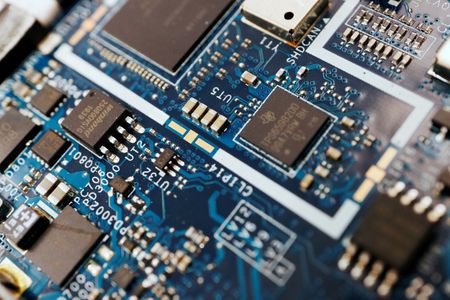

CRISTIANO AMON, PRESIDENT AND CEO, QUALCOMM

Chip-making giant Qualcomm derived 46% of its revenue in its most recent fiscal year from customers with headquarters in China.

RAJESH SUBRAMANIAM, PRESIDENT AND CEO, FEDEX CORP.

FedEx last year celebrated its 40th anniversary of operating in China, where it has nearly 11,000 employees and facilitates international shipping for Chinese customers.

PASCAL SORIOT, CEO, ASTRAZENECA

China is AstraZeneca’s second-largest market and the drugmaker last week said it will spend $2.5 billion on a research and development hub in Beijing, its second in China.

MIGUEL ANGEL LOPEZ BORREGO, CEO, THYSSENKRUPP

The German industrial giant has flagged its desire to continue investing in China’s green energy transformation with its Decarbon Technologies segment.

BELEN GARIJO, CEO, MERCK

The maker of drugs, lab equipment and semiconductor chemicals had a sizable footprint in China, which accounts for about 3 billion euros ($3.3 billion) of annual sales.

OLA KALLENIUS, CEO, MERCEDES-BENZ

China is Mercedes’ largest market and one of its largest manufacturing sites. The German automaker and its compatriots have come under pressure from local EV-makers in recent years and the company has said it will continue to spend heavily in China in coming years to protect and grow its market share.

OLIVER ZIPSE, CEO, BMW

BMW is also being squeezed in key market China, where local carmakers are gaining share with lower-cost EVs, forcing their European rivals to slash prices.

GEORGES ELHEDERY, CEO, HSBC HOLDING

Former finance chief Elhedery was promoted to the CEO role last year, becoming HSBC’s first Mandarin-speaking chief.

TOSHIAKI HIGASHIHARA, EXECUTIVE CHAIRMAN, HITACHI LTD.

Hitachi Ltd. has flagged growing pressure to lower its prices in China as economic growth slows as a concern in the year ahead.

AKIO TOYODA, CHAIRMAN, TOYOTA MOTORS

Toyota last month announced plans to establish a wholly-owned company in Shanghai to develop and produce EVs and batteries for the Lexus brand.

KWAK NOH-JUNG, CEO, SK HYNIX

The memory chip maker has a significant presence in China, with manufacturing facilities in Wuxi, Dalian, and Chongqing.

KLAUS ROSENFELD, THE SCHAEFFLER GROUP

Schaeffler Greater China has become an important supplier and business partner of the automotive and industrial sectors in the world’s second largest economy.

HUBERTUS VON BAUMBACH, CEO, BOEHRINGER INGELHEIM

Boehringer Ingelheim China, which employs 4,000 people, focuses on human pharmaceuticals, animal health and biopharmaceutical contract manufacturing.

DAVID A. RICKS, CEO, ELI LILLY

Eli Lilly secured approvals for weight-loss drug tirzepatide in China and will expand its manufacturing site in Suzhou to produce the in-demand drugs along with other pipeline medicines.

JON ABRAHAMSSON RING, CEO, INTER IKEA GROUP

IKEA serves about 90 million customers in China each year, but has said it sees ample opportunity for expansion in a market of over 1.4 billion people.

VINCENT CLERC, CEO, AP MOLLER – MAERSK

The Danish shipping giant first called into port in Shanghai in 1924 and a century later has more than 18,000 employees in China.

ROLAND BUSCH, PRESIDENT AND CEO, SIEMENS

German industrial conglomerate Siemens recently flagged muted demand in its key market of China coupled with increased competitive pressures as it factors in a reduction of orders and revenue for its industrial automation business.

ALBERT BOURLA, CEO, PFIZER

Pfizer has invested over $1.5 billion in its Chinese operations, with a focus on drugs for areas like oncology, vaccines, and rare diseases.

EMMA WALMSLEY, CEO, GSK

The global biopharma company has been increasing its dealmaking activity in China after mending its relationship local officials following a corruption scandal around a decade ago.

JAY Y. LEE, CHAIRMAN, SAMSUNG ELECTRONICS

China replaced the United States as the South Korean firm’s biggest market in 2024 thanks to strong sales of memory chips.

(Reporting by Casey Hall; Editing by Mark Potter)