By Stephen Nellis and Max A. Cherney

SANTA CLARA, California (Reuters) -Taiwan Semiconductor Manufacturing Co on Wednesday unveiled technology for making faster chips and putting them together in dinner-plate-sized packages that will boost performance needed for artificial intelligence applications.

It said its A14 manufacturing technology will arrive in 2028 and will be able to produce processors that are 15% faster at the same power consumption as its N2 chips due to enter production this year, or will use 30% less power at the same speed as the N2 chips.

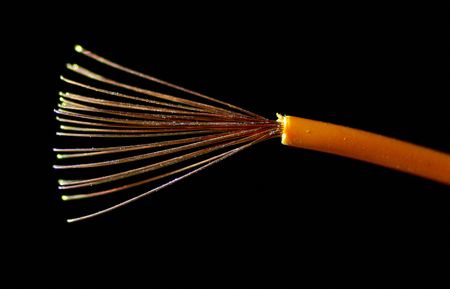

The world’s biggest contract manufacturer, which counts Nvidia and Advanced Micro Devices as clients, said its forthcoming “System on Wafer-X” will be able to weave together at least 16 large computing chips, as well as memory chips and fast optical interconnections and new technology, to deliver thousands of watts of power to the chips.

By comparison, Nvidia’s current flagship graphics processing units consist of two large chips stitched together, and its “Rubin Ultra” GPUs due out in 2027 will stitch four together.

TSMC said plans to build two factories to carry out the work near its chip plants in Arizona, with plans for a total of six chip factories, two packaging factories, and a research and development center at the site.

“As we continue to bring more advanced silicon to Arizona, you need a continuous effort to enhance that silicon,” Kevin Zhang, deputy co-chief operations officer and senior vice president, said on Wednesday.

Intel , which is working to build out a contract manufacturing business to compete with TSMC, is due to announce new manufacturing technologies next week. Last year, it claimed it would overtake TSMC in making the world’s fastest chips.

Demand for massive AI chips that are packaged together has shifted the battleground between the two firms from simply making fast chips to integrating them – a complex task that requires working closely with customers.

“They’re both neck-and-neck. You’re not going to pick one over the other because they have the technological lead,” said Dan Hutcheson, vice chair at analyst firm TechInsights. “You’re going to pick one over the other for different reasons.”

Customer service, pricing and how much wafer allocation can be obtained are likely to influence a company’s decision about which chip manufacturer would be best.

(Reporting by Stephen Nellis and Max Cherney in Santa Clara, California; Editing by Edwina Gibbs and Leslie Adler)