By Bharath Rajeswaran and Vivek Kumar M

(Reuters) -India’s benchmark indexes erased gains to end flat on Tuesday as nervousness over tensions with Pakistan tempered optimism over a potential U.S. trade deal.

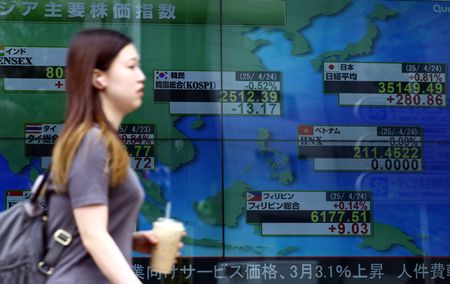

The Nifty 50 rose 0.03% to 24,335.95, while the BSE Sensex added 0.09% to 80,288.38. Both benchmarks rose about 0.5% in early trade.

U.S. Treasury Secretary Scott Bessent said one of the first trade deals to be signed could be with India as soon as this week or the next. Indian officials on Tuesday also said that bilateral talks have made “positive progress.”

“Domestic equities are rejoicing the shift of funds to emerging markets like India from the U.S., along with the rising likelihood of a bilateral trade deal,” said Sanjeev Hota, vice president and head of research, wealth management at Mirae Asset Sharekhan.

Foreign portfolio investors snapped up Indian stocks worth $4.1 billion over the last nine sessions, the longest buying streak since July 2023. The Nifty has risen 6.6% over this period.

“However, bouts of profit booking and increased volatility may emerge in the near term, given the market’s sensitivity to India-Pakistan tensions following last week’s deadly militant attack on tourists in Kashmir,” Hota said.

The Nifty volatility index has risen in four of the five sessions since the attack on April 22 to 17.37.

On Tuesday, eleven of the 13 major sectors logged losses. The broader mid- and small-caps rose 0.3% and 0.4%, respectively.

Among individual stocks, auto parts makers Samvardhana Motherson advanced 0.8% and Sona BLW jumped 6.2% after the U.S. commerce secretary said President Donald Trump will move to reduce the impact of auto tariffs.

Nifty heavyweight Reliance Industries rose 2.3%, adding to its 5.3% jump to a six-month high on Monday, following better-than-expected quarterly results. The stock has logged its best two-day rally in 15 months.

(Reporting by Bharath Rajeswaran and Vivek Kumar M in Bengaluru; Editing by Sumana Nandy, Janane Venkatraman, Savio D’Souza and Sonia Cheema)