By Johann M Cherian

SINGAPORE (Reuters) -Stocks and the U.S. dollar fell on Thursday, while longer-dated Treasury yields steadied near their highest in 18 months as worries of a worsening fiscal outlook in the world’s biggest economy remained at the top of investors’ minds.

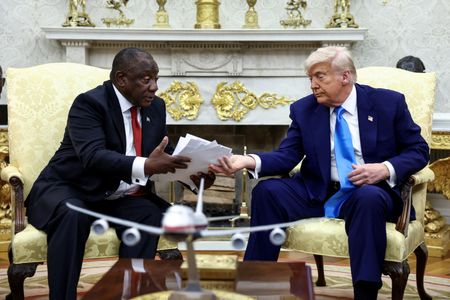

The spotlight is on U.S. President Donald Trump’s tax bill that is expected to be voted on in the House of Representatives within hours and investors are worried it could add about $3.8 trillion to the $36 trillion U.S. debt pile.

The sombre mood among investors after Moody’s downgraded the U.S. credit rating last week has left markets slightly listless as a “Sell America” narrative gains traction, with the greenback hovering near its lowest in two weeks against other major currencies. [FRX/]

European futures indicated a sharply lower open, tracking a dour Asian session, ahead of surveys on overall sector activity in Europe for May.

The data could offer some insight into how businesses have been grappling with the challenges of a cloudy outlook for the trade-reliant economy.

Investors have been looking for options outside the U.S. based on expectations it would not be immune in the event of a global recession spurred by Trump’s erratic trade policy.

“We continue to have uncertainty and worries about growth and worries about the ability of the U.S. government to raise more debt,” said Vis Nayar, chief investment officer at Eastspring Investments in Singapore.

“We’re not expecting some sort of mean reversion back toward dollar strength, but longer-term that all leads to diversification into these emerging market countries.”

Investor reluctance about buying U.S. assets was evident on Wednesday after the U.S. Treasury Department saw tepid demand for the $16 billion sale of 20-year bonds that pushed bond yields higher.

Yield on 30-year Treasury bonds steadied above 5% after hitting a 1-1/2 year high earlier in Asian hours. [US/]

“Tariff concerns have firmly shifted to concerns about global bond supply and the reverberations are being felt across all asset classes globally,” said Ben Wiltshire, global rates strategist at Citi.

“Yields are not shifting higher due to economic optimism but rather a renewed focus on net bond supply. This is why we’re seeing equities and long-end bonds both sell off.”

The bond market in Japan has also been in focus as a relentless selloff continued, with the 30-year JGB yield at 3.155%, not far from the record high of 3.185% hit in the previous session. [JP/]

Stocks in Asia fell, with MSCI’s broadest index of Asia-Pacific shares outside Japan 0.6% lower, while Japan’s Nikkei fell 0.8% on the stronger yen.

TRADE DEAL PROGRESS

The modest progress to date on trade deals has also kept investors jittery.

Attention will also be on a Group of Seven meeting in Canada, where finance ministers put a positive spin on discussions to try to reach an agreement on a joint communique largely covering non-tariff issues.

Investors have also been scouring for any hints that currency markets could be part of trade negotiations, but Thai and Japanese officials said currency markets were not part of their discussions.

Meanwhile, bitcoin rose for the fifth-straight session and touched a record high of $111,862.98 as the world’s most valuable cryptocurrency recovers from the tariff-induced selloff last month. It was last up 2.8%.

Oil prices eased on Thursday, following a strong surge in the previous session, after unexpected builds in U.S. crude and fuel inventories raised demand concerns. [O/R]

Gold prices edged up for the fourth-straight session, helped by a softer dollar and safe-haven demand. [GOL/]

(Reporting by Johann M Cherian; Editing by Jamie Freed and Saad Sayeed)