By Liam Mo and Fanny Potkin

BEIJING/TAIPEI (Reuters) -Nvidia will launch a new artificial intelligence chipset for China at a significantly lower price than its recently restricted H20 model and plans to start mass production as early as June, sources familiar with the matter said.

The GPU or graphics processing unit will be part of Nvidia’s latest generation Blackwell-architecture AI processors and is expected to be priced between $6,500 and $8,000, well below the $10,000-$12,000 the H20 sold for, according to two of the sources.

The lower price reflects its weaker specifications and simpler manufacturing requirements.

It will be based on Nvidia’s RTX Pro 6000D, a server-class graphics processor, and will use conventional GDDR7 memory instead of more advanced high bandwidth memory (HBM), the two sources said.

They added it would not use Taiwan Semiconductor Manufacturing Co’s advanced Chip-on-Wafer-on-Substrate (CoWoS) packaging technology.

The new chip’s price, production timing and above details have not previously been reported.

The three sources Reuters spoke to for this article declined to be identified as they were not authorised to speak to media.

An Nvidia spokesperson said the company was still evaluating its “limited” options. “Until we settle on a new product design and receive approval from the U.S. government, we are effectively foreclosed from China’s $50 billion data center market.”

TSMC declined to comment.

China remains a huge market for Nvidia, accounting for 13% of its sales in the past financial year. It’s the third time that Nvidia has had to tailor a GPU for the world’s second-largest economy after restrictions from U.S. authorities who are keen to stymie Chinese technological development.

Nvidia’s new GPU, despite its much weaker computing power compared to the H20, is expected to keep the company competitive despite the loss of substantial market share thus far due to export restrictions. Its main rival in China is Huawei which produces the Ascend 910B chip.

“Domestic Chinese technologies like Huawei are expected to catch up with the computing performance of downgraded versions within one to two years,” said Nori Chiou, an expert in semiconductors and investment director at Singapore-based White Oak Capital Partners.

Nvidia’s “remaining edge lies primarily in its ability to integrate AI clusters with its CUDA platform,” he added.

CUDA is the company’s programming architecture engineers use to build their AI models and apps on its GPUs. Its broad use and the ecosystem built around it makes developers keen to stick with Nvidia.

Nicolas Gaudois, head of Asia technology research at UBS, said, however, that a new GPU with conventional memory would be insufficient for some AI training and inference uses.

ANOTHER CHIP

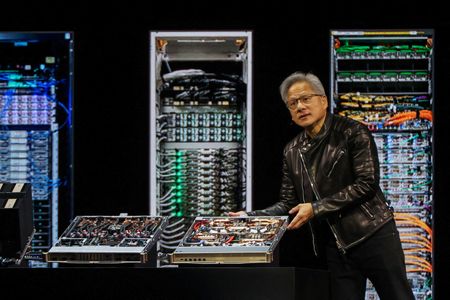

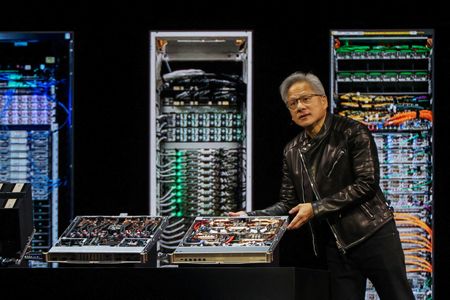

Nvidia’s market share in China has plummeted from 95% before 2022, when U.S. export curbs that impacted its products began, to 50% currently, Nvidia CEO Jensen Huang told reporters in Taipei last week.

Huang also warned that if U.S. export curbs continue, more Chinese customers will buy Huawei’s chips.

According to two of the sources, Nvidia is also developing another Blackwell-architecture chip for China that is set to begin production as early as September. Reuters was not immediately able to learn the specifications of that variant.

After the U.S. effectively banned the H20 in April, Nvidia initially considered developing a downgraded version of the H20 for China, sources have said, but that plan didn’t work out.

Huang has said the company’s older Hopper architecture – which the H20 uses – can no longer accommodate further modifications under current U.S. export restrictions.

Reuters was unable to determine the final name for the new GPU to be launched as early as June.

Chinese brokerage GF Securities said in a note published last week that it would likely be called the 6000D or the B40, though it did not disclose pricing or cite sources for the information.

The H20 ban forced Nvidia to write off $5.5 billion in inventory and Huang told the Stratechery podcast last week that the company also had to walk away from $15 billion in sales.

The latest export restrictions introduced new limits on GPU memory bandwidth – a crucial metric measuring data transmission speeds between the main processor and memory chips. This capability is particularly important for AI workloads that require extensive data processing.

Investment bank Jefferies estimates that the new regulations cap memory bandwidth at 1.7-1.8 terabytes per second. That compares with the 4 terabytes per second that the H20 is capable of.

GF Securities forecast the new GPU will achieve approximately 1.7 terabytes per second using GDDR7 memory technology, just within the export control limits.

(Reporting by Liam Mo in Beijing and Fanny Potkin in Taipei; Additional reporting by Karen Freifeld in New York and Che Pan in Beijing; Editing by Brenda Goh and Edwina Gibbs)