By Tommy Reggiori Wilkes and Jesús Aguado

LONDON/MADRID (Reuters) -The European Union has warned the Spanish government against trying to prevent banking consolidation it says is needed to create strong lenders, after Madrid announced a ministerial review of BBVA’s bid for rival Sabadell.

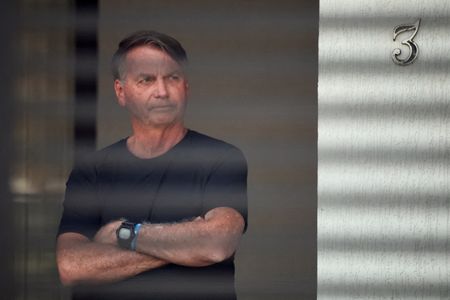

Spain’s government has opposed BBVA’s hostile move since it was made more than a year ago, citing potential risks to jobs. The economy minister Carlos Cuerpo announced the rare move on Tuesday of examining BBVA’s offer, which has been approved by the European Central Bank and Spain’s competition regulator.

The government cannot stop BBVA from buying shares in Sabadell but it can block a full merger. Now it has until the end of June to decide whether to approve the bid and whether to set conditions relating to the implications for jobs and branches.

Olof Gill, the European Commission’s spokesperson for financial services, said that there was no basis to stop a deal if it met standards on risks and competition, particularly as consolidation was vital to build stronger European lenders and in turn make the EU’s Savings and Investment Union a success.

“It is important that banking sector consolidation can take place without undue or inappropriate obstacles being imposed,” he said.

Cuerpo said he was not concerned about the EU’s warning.

“We are fully respectful of the procedure, the deadlines, and the involvement of the various institutions that are part of this process,” he told reporters.

The past year has seen a jump in European banking M&A activity, as lenders flush with cash look to make deals that industry supervisors and executives hope can create banks better able to compete with rivals in the United States and Asia.

However a number of deals have run into problems with politicians. UniCredit’s move on Commerzbank is opposed by Berlin and Italy recently imposed conditions on UniCredit’s offer for its peer Banco BPM.

BBVA says it wants to buy Sabadell to build the second largest lender in Spain, and agreed with the competition watchdog it would limit branch closures and maintain capital lines to small and medium-sized clients.

Sabadell says the deal will damage competitiveness, particularly in the area of lending to small and medium-sized enterprises, where the bank is strong.

(Additional reporting by Emma Pinedo; editing by Sophie Walker)