By Christoph Steitz, Emma Rumney and Maggie Fick

FRANKFURT/LONDON (Reuters) -European firms called on trade negotiators to redouble efforts to strike a deal with Washington after U.S. President Donald Trump threatened a 30% tariff on EU imports from August, though firms were avoiding panic, holding out hope that Trump would back off his threats as he has in recent months.

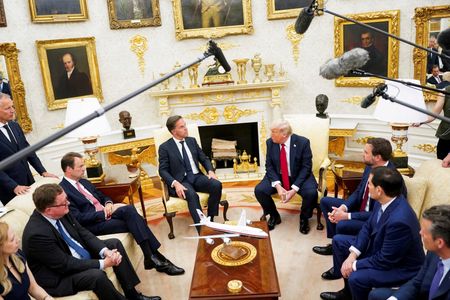

Trump on Saturday said he planned to impose higher tariff rates on imports from Mexico and the European Union beginning August 1, mounting pressure on Brussels to scramble for a deal to avert a potential massive blow to the bloc’s economy, particularly exporters in the automotive, pharmaceutical and consumer industries. The U.S.-EU trade partnership came to $975.9 billion of two-way goods trade last year, USTR data show.

Analysts said that firms were urging calm, with many expecting negotiations still to bear fruit ahead of the deadline. Trump has announced tariffs on numerous occasions only to revise his demands or push deadlines further into the future, giving rise to the so-called “TACO” trade in markets, which stands for “Trump Always Chickens Out.”

“Companies are starting to realize that this should not be panic-inducing,” said Dan Hearsch, global co-leader for automotive and industrials at consultancy AlixPartners, adding firms weren’t racing to tweak supply chains.

“Every automaker now has teams that are wired for this.”

Still, pain is becoming apparent across the business world. Volvo Car said it was currently unable to sell its ES90 profitably in the United States, and said it would take a $1.2 billion charge as a result. Shares fell 4.7%, leading European carmakers lower.

Carmakers Volkswagen, Fiat-to-Jeep owner Stellantis, Renault, BMW, Mercedes-Benz and Porsche were all down around 1-2%.

“The escalating tariff conflict with the USA poses a serious threat to many German companies,” said Volker Treier, head of trade at Germany’s DIHK chamber of commerce, urging ministers to race ahead with talks.

“Instead of summer holidays, tough negotiations are now needed to avert a collapse of transatlantic trade.”

Some EU officials called the tariff plan “prohibitive to any trade” in its current form.

The threatened 30% tariff is “separate from all sectoral tariffs,” Trump wrote in a letter to European Commission President Ursula von der Leyen, implying a 27.5% duty on autos, in effect since April, would still stand.

Three pharmaceutical sector sources added the industry was withholding judgment after various recent tariff threats from 200% levies on pharmaceuticals to the new 30% EU-wide one.

“We have a tariffs task force that has been doing a lot of scenario planning,” said one of the sources. “We are in wait and see mode until something comes into force concretely.”

UNCERTAINTY

European companies called for clarity, quick solutions, and a refocus on regional industrial capacity.

“Both sides must try to reach a fair agreement by 1 August. We should act and not wage trade wars,” said Wolfgang Große Entrup, Managing Director of German chemicals association VCI.

“However, the complicated talks also show that it is more important than ever to strengthen Europe as a centre of industry and to conclude further free trade agreements quickly.”

Mercedes-Benz said in a statement that an agreement was “crucial for the future economic success of both markets” in Europe and the United States, and for parties involved to work “intensively and as quickly as possible on a trade agreement.”

Shares in other major European firms exposed to the United States were also largely down. Regional food makers said the 30% rate, if imposed, would be “disastrous.”

Pernod Ricard, maker of Jameson whiskey, was down 1.5%, while cognac maker Remy Cointreau sank 4%. Rival Diageo, where sales of Canadian whisky and Mexican tequila drive its U.S. business, bucked the trend, up over 0.5%.

French luxury powerhouse LVMH dropped 1.5%, while consumer goods firm Nestle, Procter & Gamble and Reckitt Benckiser were down less than 1%.

(Reporting by Christoph Steitz, Amir Orusov, Ilona Wissenbach, Anna Ringstrom, Marie Mannes, Maggie Fick, Patricia Weiss, Nick Carey and Emma Rumney; Writing by Adam Jourdan; Editing by Miranda Murray, Kirsten Donovan, Louise Heavens, Bernadette Baum and Nick Zieminski)