By William Schomberg

LONDON (Reuters) -Bank of England Governor Andrew Bailey said on Tuesday the International Monetary Fund had a key role to play in tackling the buildup of risky imbalances in the world economy, many of them coming from the United States and China.

In a speech he was due to give to Britain’s finance elite, Bailey acknowledged the concerns of U.S. President Donald Trump’s administration about the danger of IMF overreach.

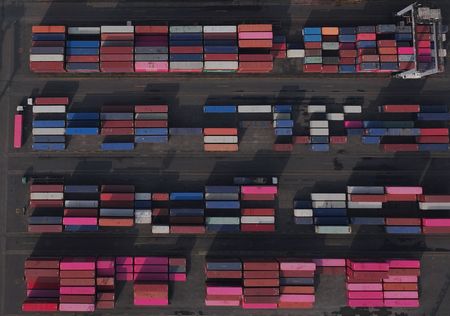

But the BoE boss said attempts to fix the problems in the world economy – chief among them the big U.S. trade and current account deficits alongside China’s big surpluses and its weak domestic demand – had to be resolved at the multilateral level.

“If it is only done at the national level, we will get less good policymaking,” he was due to tell the annual Mansion House dinner.

Bailey has previously stressed the importance of the IMF and other multilateral bodies at a time of heightened trade tensions following Trump’s imposition of high import tariffs and his threats to go further.

The IMF recently criticised another part of Trump’s economic programme – its plans for massive tax cuts. U.S. Treasury Secretary Scott Bessent has accused the Fund of straying too far from its core economic stability and surveillance missions.

Bailey said countries running big deficits were typically the ones that come under the most pressure in financial markets.

“We have seen market disturbance this year. We have to be highly alert to financial stability risks – something that I can assure you we are following closely,” he said.

Bailey also said China should free up its domestic demand as part of a global plan to tackle “excess imbalances before dangerous levels of trade restrictions come into play, and before we face the prospect of difficult adjustment with macroeconomic volatility and financial instability.”

Bailey said the IMF should consider using its powers to convene talks with member countries – chief among them the U.S. – as well as working with the World Trade Organisation to produce a nuanced assessment of the global trading system.

“I think it helps to remember that the key challenge we all face is to increase growth in the world economy: to grow the pie to support living standards for the people we serve, all of the time,” Bailey said. “It is as simple as that.”

He said he would use his new role as head of the Financial Stability Board – grouping global financial regulators – to develop with the IMF resilience tests for the global financial system, including firms such as hedge funds and banks.

Bailey also said in his speech that he favoured using digital payment technology for retail payments and bank accounts as a next step for the industry. He said he was unconvinced about the need for a retail central bank digital currency, and that stablecoins were not a substitute for commercial bank money.

(Writing by William Schomberg; Editing by Rod Nickel)