By CHRIS TAKUDZWA MURONZI

HARARE (Reuters) -Namib Minerals plans to spend $300 million to restart operations at two of its mothballed gold mines in Zimbabwe and lift production, its chief executive Ibrahima Tall told Reuters on Tuesday.

Namib Minerals owns three gold mines in Zimbabwe, including the How mine, which is currently in operation.

Tall said the funds would restart the group’s Mazowe and Redwing mines, where production was halted in 2018 and 2019 respectively due to adverse economic conditions.

Namib Minerals, which debuted on the Nasdaq in June, was created through the merger of assets previously owned by Metallon Corporation and U.S. firm Red Rock Acquisition Corporation, formerly known as Hennessy Capital Investment Corp. VI.

Production at the two suspended mines could resume within 18 to 24 months of Namib Minerals securing financing for their relaunch, said Tall, who added that the company was exploring various options of raising the required capital.

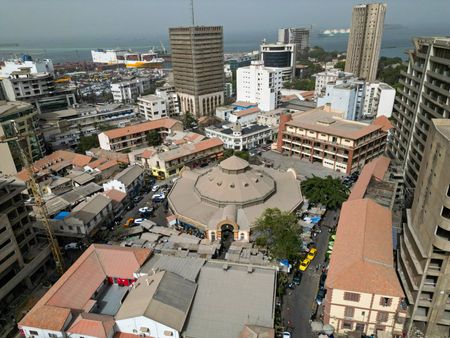

“Interest from investors on Nasdaq has been very good,” he said in an interview in Zimbabwe’s capital, Harare.

Mazowe, located north of Harare, holds 1.2 million ounces of gold at an average grade of 8.4 grams per metric ton while Redwing, near the border with Mozambique, contains 2.5 million ounces at a grade of 3.07 grams per ton.

Namib Minerals’ How Mine near Bulawayo produced 37,000 ounces of gold in 2024, a 9% increase on the previous year’s output.

Zimbabwe’s gold mines, which have for years struggled as a result of currency and policy volatility, are starting to expand output in response to record-high gold prices and relatively stable political and economic conditions.

Caledonia Mining Corp, which owns the Blanket Mine, is exploring options to raise around $250 million to build what could be Zimbabwe’s biggest gold mine.

(Reporting by CHRIS TAKUDZWA MURONZI; Editing by Nelson Banya and Joe Bavier)