By Maggie Fick and Jacob Gronholt-Pedersen

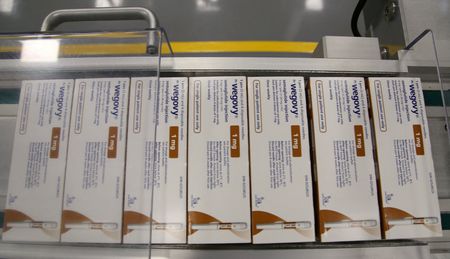

LONDON/COPENHAGEN (Reuters) -Danish drugmaker Novo Nordisk is facing a major challenge to its blockbuster weight-loss drug Wegovy.

Booming sales of Wegovy powered the company to become Europe’s most valuable, but it has lost over $400 billion in market capitalization since mid last year as competition from U.S. rival Eli Lilly and Co and copycat rivals has hardened.

The firm, which reports second-quarter results on Wednesday, has appointed a new CEO, veteran insider Maziar Mike Doustdar, who will take the reins on Thursday, and now needs to win over investors skeptical he can turn the firm’s fortunes around.

Here are some of the challenges facing the firm as it looks to bolster sales and fend off challengers after a profit warning last week sparked a share price rout.

WEGOVY VS ZEPBOUND

Novo has seen Eli Lilly’s rival drug Zepbound overtake it in terms of prescriptions in the key U.S. market this year. With Wegovy, Novo was first-to-market with a highly effective obesity treatment, which was approved in the U.S. in 2021. Lilly launched Zepbound in late 2023.

LOSING GROUND

Novo has seen its share price fall steeply versus rivals over the last year.

VALUE PREMIUM SLIPPING

That has brought its price-earnings ratio back in line with peers. It had previously commanded a wide premium.

RISING COSTS

The drugmaker has seen costs rise as it has spent billions to expand manufacturing and sales capacity.

NO LONGER TOP DOG

Novo, valued at $650 billion in June last year, has shed over two-thirds of its value since. Its latest market cap is around $212 billion.

(Reporting by Maggie Fick and Jacob Gronholt-Pedersen; Editing by Adam Jourdan and Nick Zieminski)