By Chris Prentice and Alun John

NEW YORK/LONDON (Reuters) -Global shares were mixed on Wednesday, with most major Wall Street equity indexes nudging higher and European shares retreating, while yields on U.S. Treasuries mostly rose.

U.S. President Donald Trump issued an executive order imposing an additional 25% tariff on goods from India, saying the country has imported Russian oil.

The tariffs and a larger-than-expected draw in U.S. crude lifted oil prices after four days of declines. [O/R]

MSCI’s gauge of stocks across the globe rose 0.22% to 929.26.

Shares on Wall Street were mixed, with the Dow Jones Industrial Average down 0.14% to 44,049.38, while the S&P 500 edged up 0.11% to 6,306.23 and the Nasdaq Composite advanced 0.23% to 20,964.46.

Europe’s broad STOXX 600 index turned down, last retreating 0.15%.

MSCI’s broadest index of Asia-Pacific shares outside Japan closed lower by 0.08% to 654.33, while Japan’s Nikkei rose 245.32 points, or 0.60%, to 40,794.86.

The health of the U.S. economy is a major focus for markets, and Wall Street closed lower on Tuesday after data showed services sector activity unexpectedly flatlined in July.

That reinforced the message from Friday’s soft jobs data, which caused markets to significantly increase bets on the Federal Reserve cutting rates in September.

“There’s this tug-of-war going on between the more concrete signs that we have seen that the U.S. economy is slowing and the fact that rate cuts are coming, which removes some of the pressure on valuations,” said Samy Chaar, chief economist at Lombard Odier.

Traders have been focused on tariff impacts.

“The market is more focused on the fact that we’re not getting maximalist tariffs, but I wonder if it isn’t focusing enough on the fact that we are still getting something moderate, and more could be coming, pharmaceuticals for example,” Chaar said.

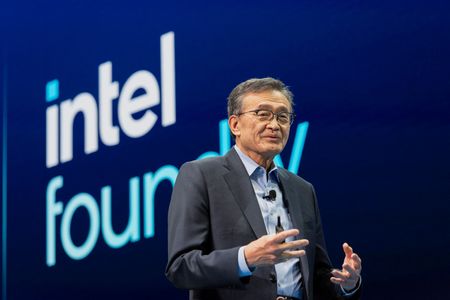

Trump on Tuesday said he would announce tariffs on semiconductors and chips in the next week or so, while the U.S. would initially impose a “small tariff” on pharmaceutical imports before increasing it substantially in a year or two.

He said the U.S. was close to a trade deal with China, and he would meet his Chinese counterpart Xi Jinping before the end of the year if an agreement was struck.

In the government bond market, Treasury yields gained ground. More supply will hit the market this week, with $42 billion in 10-year notes on Wednesday and $25 billion in 30-year bonds on Thursday. [US/]

Fed funds futures imply a 94% chance of a rate cut next month, with at least two cuts priced in for this year, according to the CME’s FedWatch.

Investors are waiting for Trump’s pick to fill a coming vacancy on the Fed board of governors. Trump said the decision will be made soon, while ruling out Treasury Secretary Scott Bessent as a contender to replace current chief Jerome Powell, whose term ends in May 2026.

European currencies gained. The euro was 0.46% higher at $1.1627. [FRX/]

The dollar index, which measures the greenback against a basket of currencies including the yen and the euro, fell 0.31% to 98.43.

Brent oil futures rose 0.92% to $68.26 and U.S. crude gained 0.94% to $65.77. [O/R]

Spot gold prices fell 0.14% to $3,376.08 an ounce.

(Reporting by Stella Qiu in Sydney and Alun John in London; Editing by Mark Potter, Bernadette Baum, Rod Nickel)