By Joe Cash

BEIJING (Reuters) -China’s exports beat forecasts in July, as manufacturers made the most of a fragile tariff truce between Beijing and Washington to ship goods, especially to Southeast Asia, ahead of tougher U.S. duties targeting transshipment.

Global traders and investors are waiting to see whether the world’s two largest economies can agree on a durable trade deal by August 12 or if global supply chains will again be upended by the return of import levies exceeding 100%.

U.S. President Donald Trump is pursuing further tariffs, including a 40% duty on goods rerouted to the U.S. via transit hubs that took effect on Thursday, as well as a 100% levy on chips and pharmaceutical products, and an additional 25% tax on goods from countries that buy Russian oil.

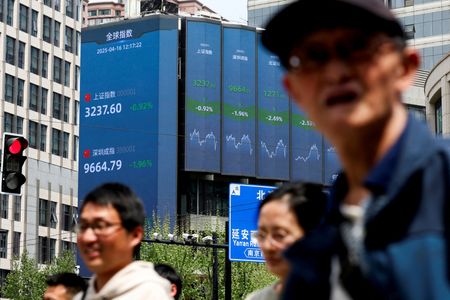

China’s exports rose 7.2% year-on-year in July, customs data showed on Thursday, beating a forecast 5.4% increase in a Reuters poll and accelerating from June’s 5.8% growth.

Imports grew 4.1%, defying economists’ expectations for a 1.0% fall and climbing from a 1.1% rise in June.

China’s trade war truce with the U.S. – the world’s top consumer market – ends next week, although Trump hinted further tariffs may come Beijing’s way due to its continuing purchases of Russian hydrocarbons.

“The trade data suggests that the Southeast Asian markets play an ever more important role in U.S.-China trade,” said Xu Tianchen, senior economist at the Economist Intelligence Unit.

“I have no doubt Trump’s transshipment tariffs are aimed at China, since it was already an issue during Trump 1.0. China is the only country for which transshipment makes sense, because it still enjoys a production cost advantage and is still subject to materially higher U.S. tariffs than other countries,” he added.

China’s exports to the U.S. fell 21.67% last month from a year earlier, the data showed, while shipments to ASEAN rose 16.59% over the same period.

The levies are bad news for many U.S. trading partners, including the emerging markets in China’s periphery that have been buying raw materials and components from the regional giant and furnishing them into finished products as they seek to move up the value chain.

China’s July trade surplus narrowed to $98.24 billion from $114.77 billion in June. Separate U.S. data on Tuesday showed the trade deficit with China shrank to its lowest in more than 21 years in June.

Despite the tariffs, markets showed optimism for a breakthrough between the two superpowers, with China and Hong Kong stocks rising in morning trade. Trump indicated earlier this week that he might meet Chinese President Xi Jinping later this year if a trade deal was reached.

TRADE UNCERTAINTY

China’s commodities imports painted a mixed picture, with soybean purchases hitting record highs in July, driven by bulk buying from Brazil while avoiding U.S. cargoes. Analysts, however, cautioned that inventory building may have skewed the imports figure, masking weaker underlying domestic demand.

“While import growth surprised on the upside in July, this may reflect inventory building for certain commodities,” said Zichun Huang, China economist at Capital Economics, pointing to similarly strong purchases of crude oil and copper.

“There was less improvement in imports of other products and shipments of iron ore continued to cool, likely reflecting the ongoing loss of momentum in the construction sector,” she added.

A protracted slowdown in China’s property sector continues to weigh on construction and broader domestic demand, as real estate remains a key store of household wealth.

Chinese government advisers are stepping up calls to make the household sector’s contribution to broader economic growth a top priority at Beijing’s upcoming five-year policy plan, as trade tensions and deflation threaten the outlook.

Reaching an agreement with the United States — and with the European Union, which has accused China of producing and selling goods too cheaply — would give Chinese officials more room to advance their reform agenda.

However, analysts expect little relief from Western trade pressures. Export growth is projected to slow sharply in the second half of the year, hurt by persistently high tariffs, President Trump’s renewed crackdown on the rerouting of Chinese shipments and deteriorating relations with the EU.

(Reporting by Joe Cash; Editing by Jacqueline Wong)