(Corrects June export growth in paragraph 3 to 5.8% from 4.8%)

(Reuters) -China’s imports of soybeans and crude oil rose in July from a year earlier, while those of coal and iron ore fell, customs data showed on Thursday.

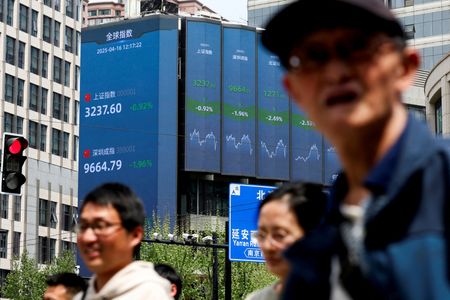

China’s exports topped forecasts last month, as manufacturers made the most of a fragile tariff truce between Beijing and Washington to ship goods ahead of a looming deadline later this month.

Outbound shipments from the world’s second-largest economy rose 7.2% year-on-year in July, customs data showed, beating a forecast 5.4% increase in a Reuters poll and June’s 5.8% growth.

Imports grew 4.1%, following a 1.1% rise in June. Economists had predicted a 1.0% fall.

KEY POINTS:

* Soybeans: July imports at 11.67 mmt, up 18.48% y/y

* Crude oil: July imports at 47.20 mmt, up 11.48% y/y

* Unwrought copper: July imports at 480,000 mt, up 9.59% y/y

* Coal: July imports at 35.61 mmt, down 22.94% y/y

* Iron ore: July imports at 104.62 mmt, down 1.26% m/m

* Rare earths: July exports at 5,994.3 mt, down 22.58% m/m

Preliminary table of commodity trade data Below are comments from analysts on the commodities data:

COMMENT ON SOYBEANS

WAN CHENGZHI, ANALYST, CAPITAL JINGDU FUTURES, DALIAN CITY:

“Brazil’s abundant soybean production has provided a strong supply foundation. Due to its bumper harvest, the peak supply period for Brazilian soybeans is expected to be longer than in previous years, remaining at a high level leading up to the fourth quarter.”

“As for China’s purchases of U.S. soybeans in the fourth quarter, no shipments have been confirmed yet, as buyers await the outcome of China-U.S. trade negotiations. Overall, a temporary mismatch between supply and demand for imported soybeans in China’s domestic market may occur in the fourth quarter.”

ROSA WANG, ANALYST, JCI, SHANGHAI:

“China’s soybean imports remained very high in July, and are expected to stay above 10 million tons in August and September. This suggests the market is preparing for potential uncertainties arising from China-U.S. trade tensions.”

COMMENT ON IRON ORE

CAO YING, ANALYST, SDIC FUTURES, BEIJING:

“The reason for a monthly fall in iron ore imports is that higher prices in July suppressed some steelmakers’ interest in stockpiling iron ore.”

“A delayed customs clearance for some cargoes because of the hit of Typhoon Wipha to many regions also contributed to a monthly fall in imports and more port congestion.”

COMMENT ON CRUDE OIL

MUYU XU, SENIOR ANALYST, KPLER, SINGAPORE:

“China’s crude oil imports fell month over month but rose on a year-on-year basis. The month-on-month decline was mainly due to reduced arrivals from Iran, Saudi Arabia, Brazil and Angola, according to Kpler’s data.”

“Independent refiners bought heavily in June, building up inventories, so their immediate demand in July was lower.

“Operating rates are also not particularly high at the moment, which does not support a sharp increase in Iranian oil purchases. Additionally, some independent refiners are facing tight import quota situations, prompting them to manage their buying pace more cautiously.”

LINKS: For details, see the official Customs website (www.customs.gov.cn)

BACKGROUND:

China is the world’s biggest crude oil importer and top buyer of coal, copper, iron ore, and soybeans.

(Reporting by Asia Commodities and Energy team; Editing by Rashmi Aich)