SHANGHAI/SINGAPORE (Reuters) -Fund manager Yang Tingwu was quick to harvest his gains after a furious July rally in Chinese steel and cement stocks, spurred by Beijing’s campaign against price wars and excess industrial production.

Yang, like many other investors, does not believe China’s ambitious plan to pull producers out of a deflationary spiral will succeed.

Reducing excessive capacity is hard to implement because closing factories “hits local tax revenues, employment, and GDP,” said Yang, a vice general manager at Tongheng Investment.

On the demand side, the property market crisis and the trade war mean “the price rebound is short-lived.”

Profit-takers like Yang threaten to kill a budding upturn in Chinese industrial stocks and commodities that was triggered by President Xi Jinping’s call last month for regulating disorderly competition, or “involution”.

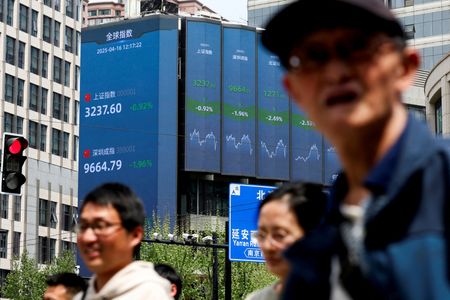

An index tracking Chinese steelmakers surged 16% in July but has softened since. Shares of cement producers shot up 23% last month but have pulled back. Share price rallies in coal, solar energy, and electric car sectors have also stalled.

The snapback points to a lack of confidence among investors that Beijing’s vow to tackle industrial overcapacity will carry much punch. The effect, if any, would also be muted by the economy’s most serious consumer slowdown in years and the biggest global trade ructions in decades.

Analysts draw parallels with China’s supply-side reforms in 2016, which underpinned a two-year uptrend in the stock market. But circumstances were hugely different then, with local households less indebted and more confident, a thriving property sector and no global trade tensions.

Yuan Yuwei, hedge fund manager at Water Wisdom Asset Management, said the recent rally was driven merely by “animal spirits”, or raw investor emotions.

“This time is different,” Yuan said.

Alexis De Mones, a London-based portfolio manager at the Ashmore Group, said much depended on how the policy is implemented and whether it impacted overall output or helped reduce disinflationary pressures.

“Is that a positive? Well, it could be positive for the stock market if it’s positive for profits growth. The impact of the anti-involution policy is still very ambiguous, I think,” he said.

FRAGILE CONFIDENCE

That lack of conviction in policy has meant prices of local commodities such as coal, glass, rebar and steel wired rod have all surrendered much of July’s sharp gains.

“Polysilicon prices jumped and then fell back. Coal prices jumped and then fell back. Why? Because there’s a severe shortage of demand,” said William Xin, chairman of Spring Mountain Pu Jiang Investment Management.

“So it’s just a quick trading opportunity.”

To be sure, some analysts are more upbeat, and look beyond just days, or weeks.

They expect more concrete measures to curb price-cutting after China suffered from 33 consecutive months of factory-gate deflation.

“Reflation appears to have gained importance on the policy agenda, with the aim of breaking the cycle of falling prices and weaker demand,” Standard Chartered said in a note.

Recent calls to rectify disorderly competition “are likely to be followed by more supply-side actions.”

The view was echoed by JPMorgan, whose analysts expect concerted efforts across China to restore pricing and investment returns to normality.

A team of equity strategists led by Wendy Liu said in a report that loss-making sectors such as lithium and solar will “see more fixes” and “may see a broad-based rally.”

In other sectors such as coal and battery, leading players may gain market share due to industry consolidation, they said.

“We see anti-involution as an 18-month trade.”

(Reporting by Shanghai Newsroom and Rae Wee in SingaporeEditing by Vidya Ranganathan and Sam Holmes)