By Jacob Gronholt-Pedersen and Soren Jeppesen

COPENHAGEN (Reuters) -Shares in Orsted plunged to a record low on Monday as the wind farm developer asked shareholders for $9.4 billion to help fund a U.S. project, after potential partners were put off by U.S. President Donald Trump’s hostility to wind power.

The 60 billion crowns ($9.4 billion) rights issue is worth around half of the Danish company’s market value as of Friday’s close.

Struggling in recent years with soaring inflation and logistical problems that sent costs soaring, the offshore wind industry faced a further setback when Trump suspended licensing on his first day back in office in January.

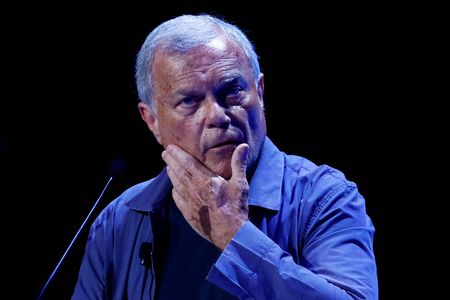

“Orsted and our industry are in an extraordinary situation with the adverse market development in the U.S. on top of the past years’ macroeconomic and supply chain challenges,” said CEO Rasmus Errboe.

Trump campaigned on a promise to end the offshore wind industry, saying it is too expensive and hurts whales and birds.

Orsted said two-thirds of the new capital would be used to fund the construction of Sunrise Wind – one of its two remaining projects under development off the U.S. East Coast.

Potential co-investors for the project pulled out after Trump’s administration in April ordered Equinor to halt the development of a neighbouring fully-permitted wind farm. The order, which sent shockwaves through the industry, was reversed the following month, however.

“Following the stop work order on Equinor’s Empire Wind project, the perceived risks of the U.S. offshore wind market among investors and banks increased significantly,” Errboe said.

Orsted depends on selling full or partial stakes in its offshore wind farms to finance new projects. Errboe, who replaced former CEO Mads Nipper earlier this year, has sought to cut costs and cancelled projects in the U.S. and Britain.

The rest of the expected proceeds from the rights issue would strengthen Orsted’s finances and help it develop the 8.1 gigawatts of offshore wind projects currently under construction by 2027, the company said.

Orsted shares lost nearly one-third of their value to hit a record low. At 1327 GMT, they were down 31.2% at 212 crowns.

“The U.S. offshore wind market was crippled after Trump took office. But things started going badly for Orsted before Trump,” said Sydbank analyst Jakob Pedersen.

‘THE ONLY OPTION’

Orsted has, in recent years, scrapped some U.S. projects and booked hefty impairments due to supply chain delays, inflation and shifting subsidy policies in the nascent U.S. offshore wind market.

“The company is in really bad shape. A capital increase was the last resort. It was not just the right decision, it was the only option they had left in their toolbox,” said Sydbank’s Pedersen.

Jefferies analysts said in a note that while the fundraising would help to de-risk the company’s balance sheet, the near-term dilution for shareholders “seems substantial”.

The Danish state, which owns 50.1% of Orsted, agreed to subscribe to a similar portion of the share issue, thus retaining a majority stake.

“Orsted is an extremely important company in the green transition, and there is also a security policy dimension where we need to be independent of energy from Russia,” Denmark’s Finance Minister Nicolai Wammen told broadcaster TV2.

Right-wing Danish opposition lawmakers criticised the government’s support for the rights issue, questioning why Danish taxpayers should help finance a U.S. project.

A spokesperson for Equinor, which holds a 10% stake in Orsted, said it would assess Orsted’s proposal. Shares not subscribed for by the existing shareholders or other investors would be fully underwritten by Morgan Stanley, Orsted said.

Orsted also said it expects to raise more than 35 billion crowns from selling its European onshore wind business as well as from planned divestments of stakes in its Changhua 2 offshore wind farm in Taiwan and Hornsea 3 in Britain.

($1 = 6.3953 Danish crowns)

(Reporting by Jacob Gronholt-Pedersen, Anna Ringstrom and Nora Buli. Editing by Terje Solsvik, Stephen Coates and Mark Potter)