By Orathai Sriring and Thanadech Staporncharnchai

BANGKOK (Reuters) -Thailand’s monetary policy should remain accommodative as the economy will face multiple headwinds in the second half of this year, including from U.S. tariffs, the minutes of the central bank’s August 13 policy meeting showed on Wednesday.

The Bank of Thailand said U.S. tariffs were expected to dampen U.S. demand and global trade activity, and their impact on the economy “was expected to be prolonged and could exacerbate existing structural challenges and competitiveness issues”.

At its meeting two weeks ago, the monetary policy committee voted unanimously to cut the one-day repurchase rate by 25 basis points to a near three-year low of 1.50%.

“Going forward, the Committee viewed that monetary policy should remain accommodative to support the economy,” the minutes said.

“At the same time, it was important to ensure macro-financial stability, while taking into account the limited policy space.”

The August cut was the fourth reduction in 10 months to support a sluggish economy grappling with U.S. tariffs and softer tourism.

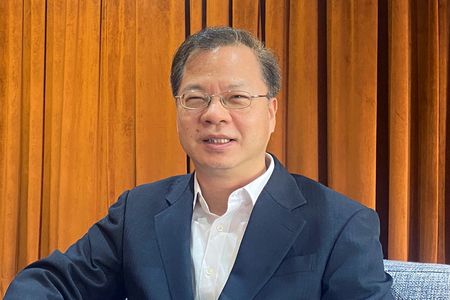

Deputy Finance Minister Paopoom Rojanasakul told reporters there is room for further rate cuts. He said while growth was expected to slow from the first half’s annual pace of 3%, he still expected it to come in above the finance ministry’s forecast of 2.2% for 2025.

Earlier this month, the United States finalised tariffs on Thai imports at 19%, which was in line with regional peers and well below the rate initially flagged in April. However, tariff rates on transshipments via Thailand from third countries remain uncertain.

At the policy review, the central bank said Southeast Asia’s second-largest economy was still expected to grow close to its forecasts of 2.3% for 2025 and 1.7% for next year. Last year’s growth of 2.5% lagged behind regional peers.

“Looking ahead, the economy was expected to moderate relative to the first half of the year, reflecting the impact of U.S. trade policies,” the minutes said, saying there were also risks from a slowdown in tourism, softening investment and consumption, and increased competition in manufacturing.

The next policy review is on October 8, and some economists expect a further rate cut.

(Reporting by Orathai Sriring, Thanadech Staporncharnchai and Kitiphong Thaichareon; Editing by David Stanway and John Mair)