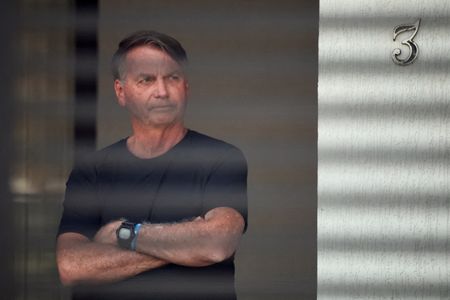

FRANKFURT (Reuters) – European Central Bank policymaker Martins Kazaks on Friday singled out the ECB’s December meeting as key to determining whether inflation was set to stray from the bank’s 2% target.

The European Central Bank left interest rates unchanged on Thursday and maintained an upbeat view on growth and inflation, dampening expectations for any further cut in borrowing costs.

Kazaks said the ECB should avoid providing any guidance in an environment marred by geopolitical risks, but said the December 18 gathering, at which the central bank will update its economic projections, was “rich” in information.

“Of course December is rich because we’ll get a new set of projections and we’ll see if there is a deviation from 2% and how large and persistent that is likely to be,” Latvia’s central bank governor told Reuters in an interview.

Sources had also told Reuters policymakers would not have enough information by their next meeting in October 29 to assess the impact of U.S. tariffs, and saw the following gathering as key.

The ECB’s latest projections, published on Thursday, see inflation falling from around 2% currently to 1.7% next year and 1.9% in 2027.

Kazaks added that a delay to the European Union’s new Emissions Trading System 2 (ETS2), which has been baked into the ECB’s projections for 2027, would have “quite a sizeable” downside impact on inflation.

“The ETS 2 is baked into our projections for 2027 and is worth some 0.3 percentage points,” Kazaks said. “If it doesn’t happen for political reasons, that would have quite a sizeable impact.”

The new EU carbon market will impose a CO2 price on suppliers of polluting fuels used in cars and buildings.

But Germany, the Czech Republic and 14 other countries have demanded the European Union introduce stricter price controls to the bloc’s new carbon market, over fears that the policy will raise consumers’ bills.

Kazaks also cited the euro’s exchange rate, which pushes down import prices when it rises and vice-versa, and potentially “deflationary” Chinese exports into the euro zone as key risks.

“So uncertainty is high and there are many risk scenarios,” he said, adding that this reinforced the case for making rate decisions meeting-by-meeting, based on incoming data.

(Reporting By Francesco Canepa; editing by Balazs Koranyi and Kevin Liffey)