By Tristan Veyet and Johann M Cherian

(Reuters) – European shares ended flat on Wednesday as investors avoided making big bets ahead of the Federal Reserve’s monetary policy decision, while Puma surged on a report of a takeover approach for the sportswear firm.

The pan-European STOXX 600 closed 0.05% lower at 550.53 points, to trade at a one-week low.

The Fed is widely expected to deliver a 25-basis-point rate cut at the conclusion of its two-day policy meeting on Wednesday, as the central bank navigates the signs of cracks in the labour market.

While the verdict is largely baked in, it will be Fed Chair Jerome Powell’s potential comments on the monetary policy outlook that will hold investors’ interest.

“But the question is: Is this the first step in a number of rate cuts to come, or is the Fed still not willing to commit to any path for interest rates in the future?”

“It is why European markets are not moving very strongly today, given that uncertainty.”

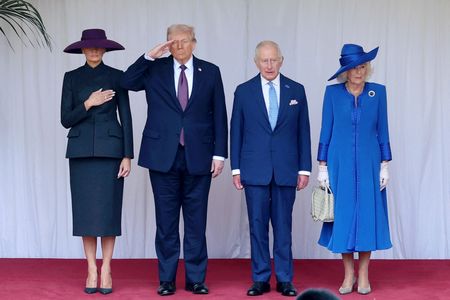

The meeting will also highlight the political influence affecting the Fed, underscored by Steven Miran – currently on leave from the Trump administration – joining the policy table, alongside Fed Governor Lisa Cook, who has so far fended off attempts by President Donald Trump to remove her.

On the STOXX 600, the oil and gas index led losses by falling 1.2%, tracking lower crude prices. It was joined by basic resources, also down 1.2%, as copper prices hit a week’s low.

Meanwhile, Puma jumped 16.7% to a near two-month high after Manager Magazin reported two parties were preparing for a potential takeover of the German sportswear maker. Peer retailer Adidas was up 1.7%, while JD Sports added 0.5%.

Jamie Salter of Authentic Brands and Alex Dibelius of CVC expressed interest in the Pinault family’s 29% stake.

Commerzbank CEO Bettina Orlopp labelled UniCredit’s approach for a potential merger as “unfriendly” and said any deal would likely hurt revenue.

Commerzbank fell 2.7% and UniCredit lost 3.5%, driving the regional banking index 1% lower.

On the flipside, technology stocks capped overall losses, with SAP recovering 3.2% after Jefferies analysts saw scope for shares to regain lost ground on resilient cloud intake and free cash-flow outlook. Shares of the company had been falling recently on concerns over slowing cloud growth. It hit an 11-month low on Tuesday.

Despite uncertainty around tariffs and regional political turmoil, particularly the recent collapse of the French government, European shares have managed to stay afloat, albeit with some dents to sentiment.

UBS equity strategists have raised their 2025 and 2026 forecasts for the STOXX 600 index on expectations that earnings downgrades could slow, and as surveys point to an improvement in new orders.

In other stocks, Danish drugmaker Novo Nordisk rose 2.9% after Berenberg upgraded the index heavyweight stock to “buy” from “hold”.

ProSiebenSat.1 slipped 2.4% after the German broadcaster cut its 2025 forecasts.

(Reporting by Tristan Veyet in Gdansk and Johann M Cherian in Bengaluru, editing by Rashmi Aich, Harikrishnan Nair and Chris Reese)