By Ishaan Arora

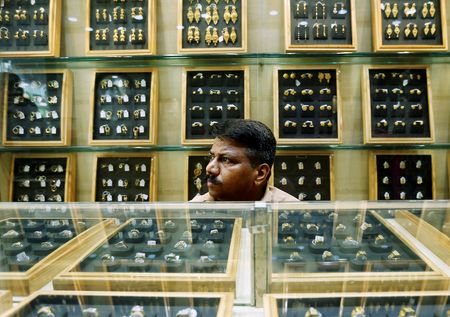

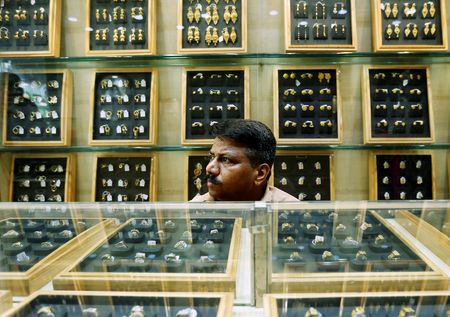

(Reuters) -Gold held steady near record highs on Thursday, as heightened expectations of further U.S. interest rate cuts this year and political uncertainty on account of a contentious U.S. government shutdown drove demand for the metal.

Spot gold was up 0.2% at $3,865.73 per ounce by 0810 GMT, down from Wednesday’s all-time high of $3,895.09. U.S. gold futures for December delivery fell 0.2% to $3,890.80.

The U.S. dollar index inched lower to hover near one-week lows reached on Wednesday. [USD/]

Data showed on Wednesday that U.S. private payrolls fell by 32,000 jobs in September after a downwardly revised 3,000 decline in August.

“Overall, a softer dollar, weak economic data as highlighted in yesterday’s ADP print, and the government shutdown continues to attract demand from investors looking to join the momentum train,” said Ole Hansen, head of commodity strategy at Saxo Bank.

The U.S. government has shut down much of its operations, potentially putting thousands of federal jobs at risk, and possibly delaying the release of economic indicators, including the key non-farm payrolls (NFP) report due Friday.

Traders are pricing in a near-certain 25-bp interest rate cut this month, according to the CME FedWatch tool.

Gold, viewed as a safe-haven asset during times of political and economic uncertainty, thrives in a low-interest-rate environment.

Gold remains Goldman Sachs’ highest-conviction long commodity recommendation, the bank said in a note on Wednesday,

“The upside risks to our $4,000/oz mid-2026 and $4,300/oz December 2026 gold price forecasts have intensified further due to speculative positioning and large upside surprise to Western ETF holdings,” Goldman Sachs added.

SPDR Gold Trust, the world’s largest gold-backed exchange-traded fund, said its holdings rose 0.59% from Tuesday to 1,018.89 metric tons on Wednesday, their highest since July 2022.

Elsewhere, spot silver rose 0.2% to $47.41 per ounce, platinum climbed 1.2% to $1,575.06 and palladium gained 1.7% to $1,265.75.

(Reporting by Ishaan Arora in Bengaluru; Editing by Louise Heavens)