By David Milliken

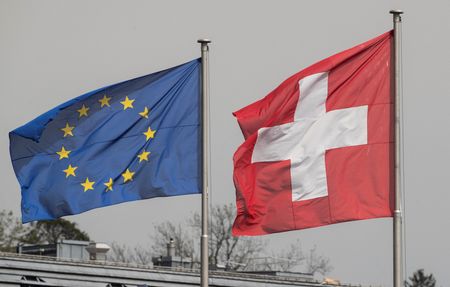

WASHINGTON (Reuters) -Brexit is likely to continue to weigh on British economic growth over the coming years, offering a warning to the wider world of the damage caused by erecting trade barriers, Bank of England Governor Andrew Bailey said on Saturday.

The BoE has long forecast that Britain’s 2016 vote to leave the European Union would hurt exports due to greater regulatory frictions, despite a 2020 agreement to keep tariff-free trade between Britain and the European Union.

“If you ask me what the impact is on economic growth … the answer is that for the foreseeable future it is negative, but over longer time (horizons) there should be a positive, albeit partial, counterbalance,” Bailey told the Group of Thirty, a gathering of central bankers and financiers in Washington.

Finance leaders from across the world have been meeting in Washington this week for the annual meeting of the International Monetary Fund, where the impact of U.S. tariffs have been high on the agenda.

Bailey said Brexit highlighted that businesses could adapt to tougher trade conditions, but that it took time and growth would still be less than otherwise.

“Make an economy less open and it will restrict growth, though over a longer time trade will adjust and rebuild. And, this appears to be what has happened. The same argument holds for the world economy and tariffs,” he said.

The British government’s Office for Budget Responsibility estimates that Brexit will reduce Britain’s long-term level of productivity by 4% compared with remaining in the EU.

Bailey also highlighted headwinds to growth from an ageing population and a lull in the pace at which technological progress translates into higher living standards.

(Reporting by David Milliken; editing by Dan Burns)