By Sam Li and Chen Aizhu

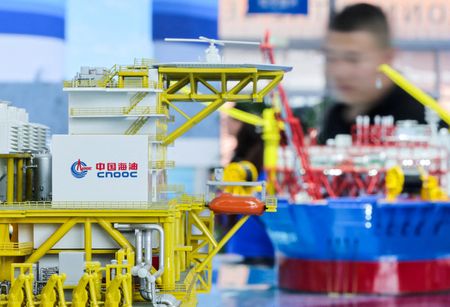

BEIJING (Reuters) -Chinese offshore oil and gas major CNOOC Ltd reported on Thursday a 12.2% decline in third-quarter net income from a year earlier as lower global oil prices offset strong production growth.

Net profit during the July to September period was 32.44 billion yuan ($4.55 billion), CNOOC said in a filing with the Hong Kong Stock Exchange.

Domestic rival Sinopec Corp reported flat third-quarter profit but faced a one-third tumble in net income during the first nine months.

CNOOC’s revenue rose 5.7% year-on-year in the third quarter to 104.9 billion yuan, as the company boosted reserves and output, and strengthened cost competitiveness.

But the revenue from oil and natural gas sales declined 3% in the third quarter and fell 5.9% in the first three quarters due to the drop in oil prices.

Oil and natural gas production was up 6.7% to 578.3 million barrels of oil equivalent (boe) during the first three quarters, with natural gas up 11.6% year-on-year.

Production from China expanded at a faster pace of 8.6% year-on-year during the nine-month period to 400.8 million boe while overseas production rose 2.6% to 177.4 million boe.

Output in North America, the UK as well as Nigeria slowed but new projects in Guyana and Brazil enjoyed fast growth, the company said.

Capital spending was 86 billion yuan in the first three quarters, down 9.8% from a year earlier due to less work volume on projects under construction.

The company made five new discoveries and successfully appraised 22 oil and gas-bearing structures, including Kenli 10-6 in Bohai Bay off north China and deepwater Lingshui 17-2 in the South China Sea.

During the first nine months, CNOOC began production at 14 new projects such as Kenli 10-2 oilfield in Bohai Bay, Dongfang 29-1 gas project in the South China Sea and the Yellowtail Project in Guyana.

CNOOC’s Hong Kong-listed shares have gained about 4.71% year to date, underperforming the benchmark Hang Seng Index, which has risen nearly 31.02%.

($1 = 7.1230 Chinese yuan)

(Reporting by Aizhu Chen and Sam Li)