By Duncan Miriri

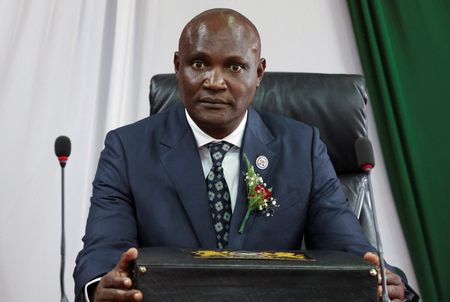

NAIROBI (Reuters) -Kenya will hold further talks with the International Monetary Fund to overcome the key obstacles that have so far prevented it from securing a new support programme, the country’s Finance Minister John Mbadi said on Tuesday.

The East African nation formally requested a new lending programme after the expiration of the previous $3.6 billion deal in April and talks were held in Washington last month after an IMF mission to Nairobi in September.

Mbadi told a news briefing that the two sides were continuing to discuss whether securitised loans being used to fund major infrastructure upgrades should be treated as sovereign debt or not.

BURDENSOME DEBT LOAD

President William Ruto, who took power three years ago, has faced difficult choices after inheriting a heavily indebted economy, despite GDP growth that hit 5% in the second quarter. A series of taxes imposed by the government sparked deadly, youth-led protests last year.

His government has turned to ring-fencing of some revenue streams and borrowing against them through special entities, in a process called securitisation.

“Our position as a government is that once you sell a right to a special-purpose vehicle, and there is no risk at all to the government… then we shouldn’t treat it as a debt,” Mbadi said.

“But IMF feels we should treat it as debt. Whichever way, we will agree,” he said.

Further talks will be held, he said, without specifying when.

The government will issue a securitised bond this month to raise 175 billion shillings ($1.36 billion) for road building, Mbadi said. It will be backed by a roads maintenance levy charged to motorists for fuel.

EXPANSION OF AIRPORT, RAILWAY TO UGANDA

It also plans to raise billions of dollars for the expansion of its main Nairobi airport and a key railway line from the Kenyan coast to the border with Uganda.

Many analysts argue Kenya needs a new IMF programme to anchor its external debt repayments but Mbadi said IMF funding was not yet factored into the government’s budget for this fiscal year.

“If it comes, it will be a windfall for us… It may help us reduce some other loans, whether domestic or external,” he said.

Mbadi denied domestic media reports, meanwhile, that the stability of the country’s exchange rate was another stumbling block in IMF talks.

He said the currency was supported by healthy hard currency reserves, higher export earnings, growth in tourism and the country’s diaspora.

($1 = 128.9500 Kenyan shillings)

(Reporting by Duncan Miriri; Editing by Marc Jones and Conor Humphries)