(Refiles to change dateline)

By Maria Martinez

BEIJING (Reuters) -Germany’s finance minister became the first representative of the new coalition government to visit China on Monday, with Berlin under pressure to show it has a handle on China policy as a record trade gap widens and supply chains wobble.

Lars Klingbeil’s arrival in Beijing comes more than six months after Germany’s conservative-led coalition took office and follows a cancelled visit by Foreign Minister Johann Wadephul last month over China’s rejection of most meetings on his proposed agenda.

German officials emphasised that Klingbeil would be discussing big trade issues, such as Chinese limits on rare earths. A finance ministry source said positions had been agreed in advance with EU officials responsible for Germany’s trade policy as a member of the bloc.

“Access to critical raw materials and the reduction of Chinese overcapacity in sectors such as steel and electric mobility are of great importance for the economy and jobs in Germany,” Klingbeil said in Berlin before departing for Beijing.

It is also important at home that the coalition shows it can finally get a hearing in Beijing and a grip on the relationship.

U.S. President Donald Trump’s trade war has hurt Germany’s exports, left Berlin vulnerable to a surge in diverted imports of Chinese goods, and ignited new supply chain fears, most recently over rare earth metals and automotive chips.

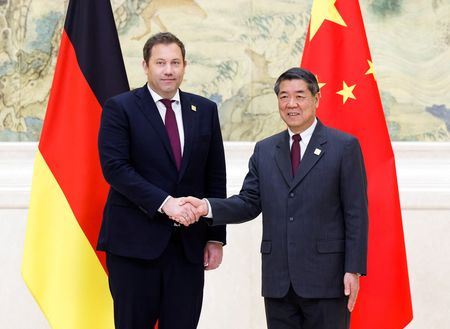

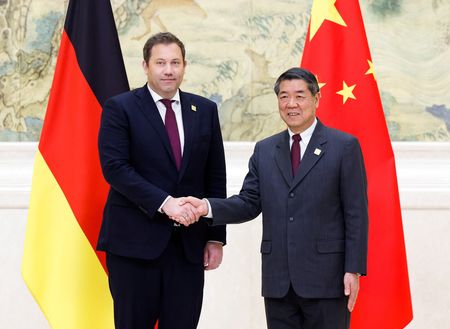

Klingbeil will meet Vice Premier He Lifeng for the German-Chinese financial dialogue, a format established in 2015. He is accompanied by Bundesbank President Joachim Nagel and a small delegation of German banks and insurance companies.

“Europe and China are in a very ambiguous relationship. On the one hand, we need them; on the other hand, we’re concerned by security issues,” said Denis Depoux, global managing director at Roland Berger.

On Wednesday, Klingbeil will travel to Shanghai to meet heads of German mid-sized companies before heading to Singapore.

‘POLITICAL WILL’ NEEDED FOR ‘DECISIVE CHOICES’

In recent weeks, Chinese limits on trade in rare earth elements and a quarrel between Beijing and the Netherlands over exports by the automotive chip supplier Nexperia have sounded big wake-up calls in Europe.

“Recent months have shown that China’s export control measures can impact German industry nearly to the extent of stopping production,” said Maximilian Butek, executive director and board member of the German Chamber of Commerce in East China. “China really showed its muscles when it comes to rare earth.”

In Germany, politicians have called for a full-blown reassessment of policy towards Beijing, some accusing the previous Social Democrat-led government of having let Germany become too dependent on China, both as a market for industrial exports and as a supplier for critical materials.

Jacob Gunter, head of the economy and industry programme at the think tank Merics, said only “more decisive pain” would “allow for the political will to make some decisive choices”.

Germany’s parliament appointed an expert commission on Thursday to rethink trade policy towards China.

“The Nexperia example should spur us to talk and demand transparency – otherwise a business problem gets used as a geopolitical issue,” said Volker Treier, head of foreign trade at the German Chamber of Commerce DIHK.

“It must be clear to the Chinese government that we cannot accept economic and political interests being mixed together,” said Juergen Hardt, foreign policy spokesperson for Chancellor Friedrich Merz’s CDU party.

TRADE DEFICIT WITH CHINA WIDENS

Trump’s tariffs are pushing Chinese companies to divert exports from the United States to Europe.

“Industries are sounding the alarm on competition with China – we need quick measures to offset distortions and strengthen our own competitiveness,” said Ferdinand Schaff, senior manager for greater China at the BDI industry association.

China overtook the U.S. as Germany’s largest trading partner in the first eight months of 2025. Germany faces a record trade deficit of 87 billion euros ($101.46 billion) with China this year, according to a forecast by state-owned international economic promotion agency Germany Trade & Invest.

“As the U.S. market partially closes, China is trying to sell more here – our trade stats show it. That’s why this dialogue is so important,” Treier said.

While German exports to China fell 13.5% year-on-year from January to August, imports rose 8.3%.

“Germany is uniquely exposed to the risks of Chinese industrial overcapacity—and it’s going to hit very hard,” said Gunter from Merics.

(Reporting by Maria MartinezEditing by Peter Graff and Saad Sayeed)