By Sethuraman N R

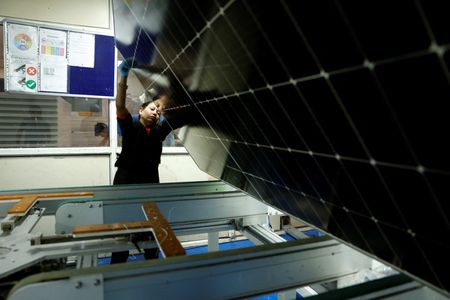

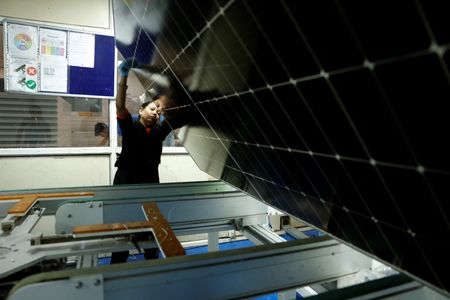

NEW DELHI (Reuters) -India’s solar module exports fell sharply in September to their lowest this year after U.S. trade measures curbed shipments, forcing manufacturers to redirect supplies to the domestic market, industry officials and analysts said.

India’s exports to the United States had surged earlier this year as developers sought alternatives to Chinese panels amid Washington’s restrictions on Chinese products.

The U.S., which accounted for more than 90% of India’s module exports earlier this year, imposed a 50% tariff on Indian goods during the Trump administration and has since tightened scrutiny on imports as it investigates whether Chinese-made components are being shipped from India.

India’s September solar module exports slumped to about $80 million from $134 million in August, government data showed.

The investigative risk from the U.S. and tariff imposition have materialised for some players, said Girishkumar Kadam, senior vice president at ratings agency ICRA.

India’s approved solar module manufacturing capacity stands at about 110 gigawatts and is expected to cross 165 GW by March 2027, according to ICRA.

DOMESTIC OVERSUPPLY FEARS GROW

However, the slowdown in overseas demand has heightened fears of oversupply in the domestic market, where annual solar installations remain below the 44–45 GW needed to meet 2030 renewable targets.

Analysts expect consolidation among smaller module-only firms as margins come under pressure. Vertically integrated players with cell and wafer capacity are likely to weather the downturn better, they said.

In August, the All India Solar Industries Association urged the Indian Banks’ Association to stop funding new, unviable module manufacturing projects to avoid future bankruptcies, according to a letter reviewed by Reuters.

Some Indian companies are focusing more on adding cells, ingots and wafer lines instead of modules.

Solex Energy, for example, said it has scaled down plans to build 15 GW of modules to 10 GW and will now make 10 GW of cells instead of the original plan of having 5 GW.

“The plan to scale down the module making was a conscious one as the company did not want to add to the potential overcapacity that could lead to price wars in the future,” said Vipul Shah, a director at Solex.

(Reporting by Sethuraman NR)