By Patrick Wingrove

(Reuters) – Eli Lilly investors and analysts said they want to hear details from the company on how exactly it plans to grow U.S. sales of popular weight-loss drug Zepbound after it last month forecast lower-than-expected fourth-quarter revenues for the drug.

Lilly, which reports its fourth-quarter earnings on Thursday, said in January that wholesalers had not restocked their Zepbound inventories as expected, driving shares down 8%. It was the second time in a year its sales had come up short due to issues it attributed to the supply chain.

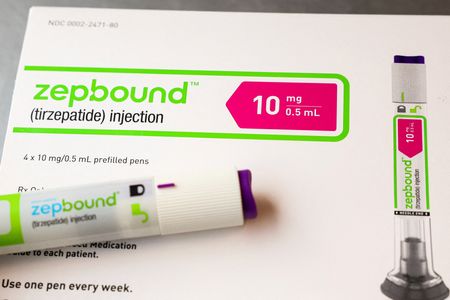

Zepbound, the weight-loss version of diabetes drug Mounjaro, was approved in late 2023 and has had a meteoric rise since, with millions of customers seeking it or its rival Novo Nordisk’s popular weight-loss drug Wegovy.

Demand was so high that Zepbound was in shortage for much of last year, according to the U.S. drugs regulator. The medicine, which has been shown to reduce weight by up to 20%, sells for $650 per-month supply on its website for patients who have insurance that does not cover the drug.

One investor and three analysts told Reuters they expect Lilly to share details on how it plans to promote Zepbound this year in a bid to take more market share from Wegovy, an older, more established drug.

“Wegovy is still the household name, but Zepbound has (taken) market share over the last half year with limited market expense. What happens if they ramp that up?” said Christian Greiner, equity portfolio manager at F/m Investments, which holds Lilly shares.

Zepbound’s market share stands at just over 50%, according to IQVIA data shared by an analyst, with Lilly having started advertising the drug in November.

Lilly could leverage its December data showing patients taking Zepbound lost 47% more weight than those given Wegovy, including in televised advertisements, with a view to getting non-specialist frontline doctors to prescribe the drug, the investor and analysts said.

The drugmaker could also explain how it plans to promote Zepbound to older Americans covered by Medicare, now that the U.S. government health program for people aged 65 and older or who have disabilities has said it will cover the drug as a treatment for sleep apnea, they said. Zepbound is expected to be approved as a treatment for heart failure later this year as well, they noted, expanding Medicare coverage.

Lilly Chief Financial Officer Lucas Montarce told Reuters last month the drugmaker is trying to balance its demand-generation activities with its ability to supply more patients. The company last year invested billions of dollars into its manufacturing capacity to ramp up Zepbound supplies and those of Mounjaro.

Lilly last month said it expects $1.9 billion in Zepbound sales this quarter. Analysts on average now expect the drug to bring in about $2 billion for the fourth quarter and to generate 2025 sales of more than $11 billion, according to data compiled by LSEG.

Goldman Sachs analyst Chris Shibutani said Lilly could also talk about its manufacturing and sales plans for its experimental oral obesity drug orforglipron, ahead of late-stage trial data expected later this year.

He said Lilly could potentially more easily scale up manufacturing for the drug, developed in pill form, and launch it internationally much faster than it could for Zepbound, an injectable medicine.

“What’s very important is that opportunity to capitalize on being potentially first in orals,” he said.

(Reporting by Patrick Wingrove in New York; Editing by Caroline Humer and Chris Reese)