By Manvi Pant

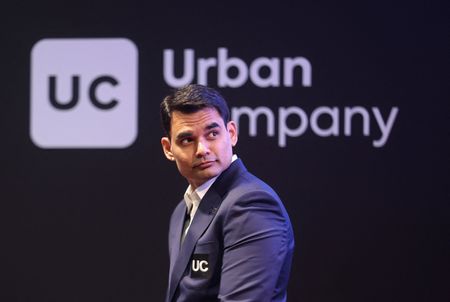

(Reuters) – Shares of home services platform Urban Company jumped 74% in trading debut on Wednesday, notching a valuation of nearly $3 billion, as investors bet on its dominant position in a mostly untapped market.

The stock was trading 63% higher, as of 11:32 a.m. IST, after hitting a day’s high of 179 rupees.

It was listed at 162.25 rupees on the National Stock Exchange of India, a 57.5% premium on the issue price and surpassing expectations of two analysts who had predicted it at 40%-51% premium.

India’s online on-demand home services market is expected to grow at a compound annual growth rate of 22.4% from 2023 to 2030, according to data firm Grand View Research.

The industry is largely unorganised and diversified, analysts have said. It leaves the Gurugram-based Urban Company, which offers everything from facial treatments to plumbing repairs, only a few competitors, mostly regional and offline service providers.

“Investor excitement stems from viewing this (Urban Company) as a structural long-term play on digital adoption and a proxy for the rising demand in home services,” said Aishvarya Dadheech, founder of Fident Asset Management.

Among the biggest IPOs so far in 2025 – including HDB Financial, Hexaware Tech and Ather Energy – Urban Company’s offering was the most subscribed at 103.65 times. It garnered bids worth about $13 billion.

The stock’s performance also tracks positive sentiment in the broader equity markets as traders were optimistic around the U.S.-India trade negotiations following discussions between the two countries.

The blue-chip Nifty 50 has risen 7.1% so far in 2025 but is still about 4% lower from the record levels notched about a year ago. It was trading about 0.3% higher on the day. [.BO]

($1 = 87.7325 Indian rupees)

(Reporting by Manvi Pant; Editing by Harikrishnan Nair)