By Elisa Anzolin, Dominique Patton and Mimosa Spencer

MILAN (Reuters) -Armani’s economic value goes well beyond its stagnating fashion business and potential bidders are likely to take a close look at sales generated by fragrances and frames sold under the late designer’s name, industry sources and analysts say.

The fashion house founded by Giorgio Armani 50 years ago reported revenue of 2.3 billion euros ($2.71 billion) last year, down 5% from a year earlier amid a global luxury slowdown and as a turn to casualwear reduces the appeal of its classic suits.

But filings by the Italian company show that figure nearly doubles, to 4.25 billion euros, with the inclusion of sales from beauty and eyewear – made under licence since 1988 by L’Oreal and EssilorLuxottica respectively.

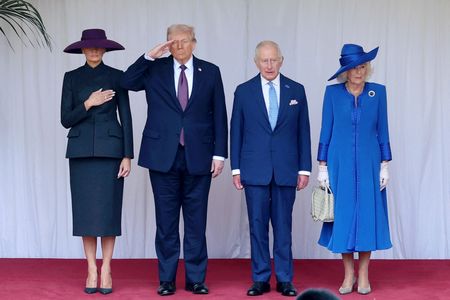

Giorgio Armani’s will, published last week following his death on September 4, named those two companies alongside French luxury giant LVMH as potential buyers of the business.

Armani-branded perfumes and beauty products in L’Oreal’s portfolio generate around 1.5 billion euros a year, industry sources and analysts estimate, while Armani eyewear contributes about 500 million euros for EssilorLuxottica.

Just over one-tenth of that goes to the Armani group as royalties, according to Reuters calculations based on filings.

Sales of licensed products could be fundamental to determining the price of Armani in a possible transaction, according to an industry source who has worked at a potential suitor.

While operating profit for Armani group, which depends largely on fashion, shrank to 3% of net revenue last year, the beauty and eyewear businesses are potentially more lucrative. L’Oreal reported an overall operating profit margin of 20% last year, while EssilorLuxottica’s stood at nearly 17%.

The Armani brand is “great eyewear, great beauty, a great legacy, but the ready-to-wear brand today is not the hottest on the planet,” HSBC analyst Erwan Rambourg told Reuters.

LICENCES CENTRAL TO POTENTIAL SALE

Armani’s licence with EssilorLuxottica, in which the designer owned a 2% stake, was renewed in 2023 for 15 years. And the deal with L’Oreal runs until 2050.

Aware of the importance of these collaborations, Giorgio Armani’s will states that priority for any sale should be given to groups with which his company “already has a partnership”.

EssilorLuxottica and L’Oreal said last week they would assess a possible investment in Armani, which the will says should initially be a 15% stake. A second, larger stake should be transferred later to the same buyer or a listing sought, the will says.

LVMH, controlled by French billionaire Bernard Arnault, said it was honoured to be named as a potential partner.

Maintaining control of the sizeable Armani licence through a large stake purchase would be more significant for L’Oreal than for EssilorLuxottica.

A bid by L’Oreal for Armani may follow the precedent set by beauty group Estee Lauder, which purchased fashion label Tom Ford in 2022, keeping the fragrances but granting long-term licences to other players for apparel and eyewear.

Armani is “highly regarded” as a beauty brand, said Morningstar analyst Dan Su. It is also one of the best-known names in men’s fragrances, a segment that is booming – L’Oreal CEO Nicolas Hieronimus told Reuters in July that its “Stronger with You” fragrance was a “phenomenon” among younger men.

Managing a fashion label in addition to beauty could add complexity for L’Oreal.

And despite their long collaboration, Armani would be a tough nut to crack for EssilorLuxottica, which dipped into fashion by acquiring streetwear brand Supreme in 2024, but has stressed its aim to become a med-tech group.

LVMH, with its depth and breadth of luxury expertise, would have the ability to manage a full acquisition that brings in-house the full suite of Armani’s sprawling businesses, several industry experts said.

The French conglomerate could manage eyewear via its Thelios unit, while beauty is already a core business.

But LVMH may struggle to bring Armani beauty and eyewear in-house any time soon given the existing long-running licences.

Boss Arnault would also have to cohabit with a foundation set up by Armani that will hold de facto veto powers.

“LVMH and L’Oreal are like chalk and cheese,” said Rambourg.

($1 = 0.8474 euros)

(Reporting by Elisa Anzolin and Lisa Jucca in Milan, Mimosa Spencer and Dominique Patton in Paris; Additional reporting by Anousha Sakoui and Elvira Pollina; Editing by Lisa Jucca, Richard Chang and Catherine Evans)